February 10, 2021, 1:06 pm EST

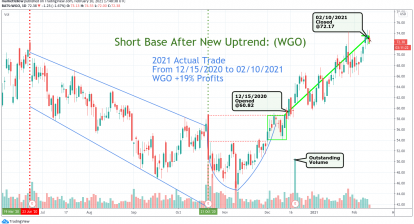

2021 Actual Trade: WGO +19% Profits

Stock markets or any stock consists of an uptrend, downtrend, and sideways. The trend may change its direction because of changes in its business fundamental through earrings and market perception.

Here is an example of Winnebago (WGO) that changed its downtrend to uptrend after earning reports on 10/21/2020.

Investors tried to study its report in the next five weeks until the end of November. Here we noticed bias began to change. Technically, it is easy to see WGO terminated its downtrend and going sideway between 45-54 during this 5 week period.

Not only investors are ready to accumulate WGO, but traders and trend followers were also ready to get in. The question is to identify the perfect entry point so that you only see green color in your portfolio rather than red color, even it is a minor percentage.

The key is to trace WGO closely for the first two weeks of December. We can see WTO oscillated between 54 and 59 with mild volume. The most important numbers are 54 and 59. 54 means its support and 59 is the resistance. So, it is time to load up your gear and get ready.

12/15/2020 was the day that WGO broke through 59 resistance. Thus, we got in WGO at 60.82.

The rest of the story is simply a scenic uphill ride with beautiful views and quick +19% profits within two months.

We had published two articles on Winnebago (WGO) for references.

https://marketfellow.com/2020/12/15/stock-picks-new-lifestyle-for-post-pandemic-era-wgo/

https://marketfellow.com/2020/12/18/stock-analysis-winnebago-the-way-to-go-wgo/