April 6, 2021, 2:36 pm EDT

Stay Calm At All-Time Highs

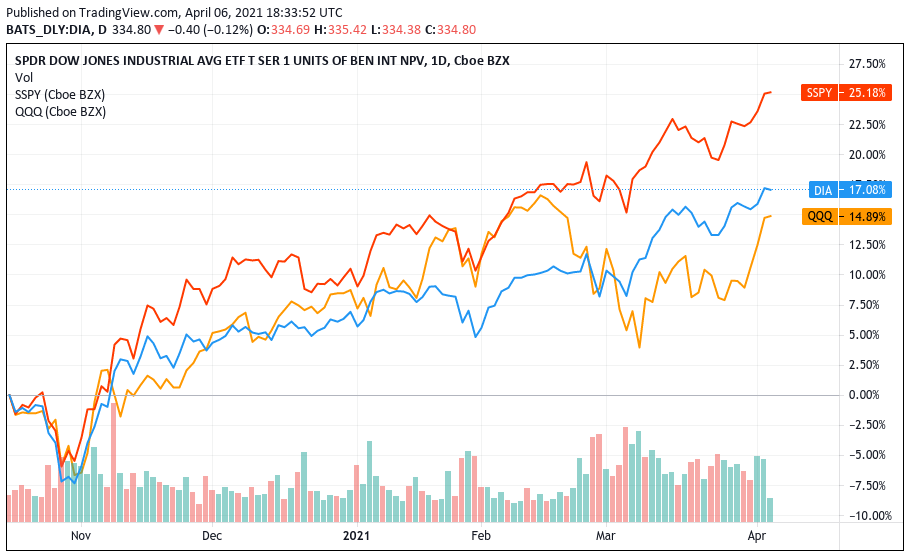

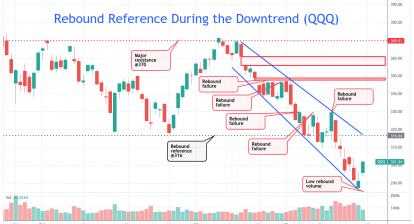

Stock markets re-enter hyper bullish mode at record highs zone for S&P and Dow Jones. Nasdaq is also getting back to a near-record high. But. it would be essential to stay calm because of the low volume and lack of leadership.

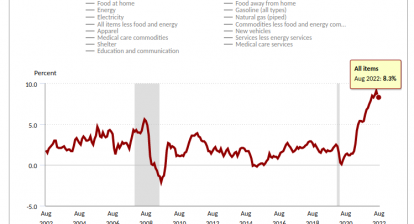

Airlines, retailers, hotels, and China stocks come back to strength with the expectation of the post-COVID era and speculative markets. The main reasons are government support or market-friendly policies like stimulus, spending, low-interest rates, etc. Furthermore, re-opening businesses would stir up economic activities and job markets. These assumptions may be possible.

However, prudent investors or traders should always stay calm and take calculated risks in investment decisions.

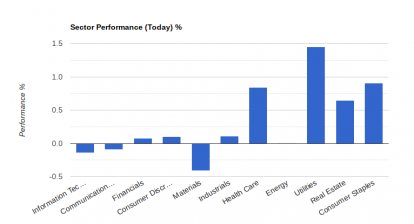

We prefer a mixed bias portfolio with offensive positions in semiconductor, consumer discretionary, material, biotech, and defensive positions in food, REIT, and utility.

Recent strength in silverlike AG, PAAS, KGC is worth attention also.

In summary, overall stock markets are bullish and overbought. Any new positions should be carefully checked on the risk-reward ratio.