April 28, 2021, 1:02 pm EDT

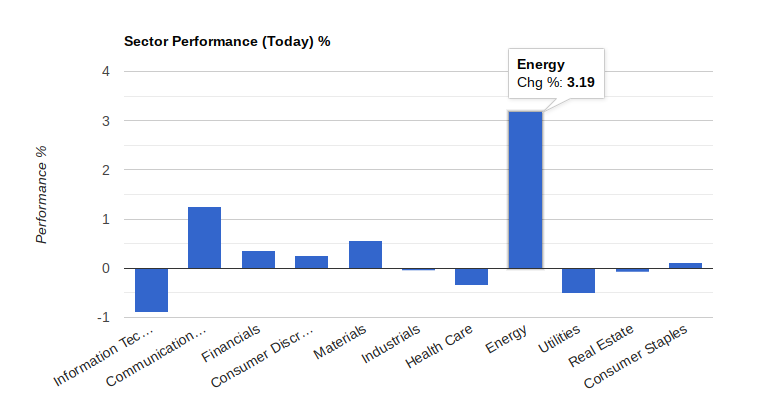

Dollar Falls and Energy Jumps

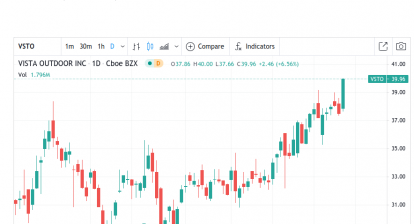

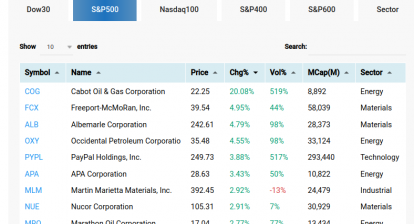

The falling US dollar may be one of the driving power behind rising oil and energy stocks today. (NOV, APA, DVN, HES, MRO, FANG, XEC all +5% now).

Other highlighted stocks are financial COF and SYF.

GOOGL and AMZN represent the leaders for technology.

Other than above, there is not much worthy mention in today’s market.

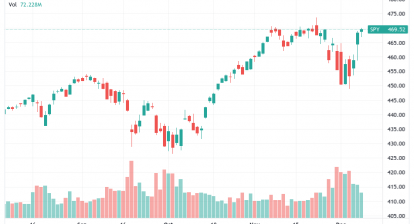

Stock markets swing in the narrow range in the past two weeks. All indexes locate at a record high level so bias has to be bullish. The main problem for market participants is that where is the list of stocks to buy. The answer is very few.

This rally is driven by US government-assisted policies which made the US dollar weaker. Furthermore, low-interest rates made housing prices to another record high level. In our opinion, it makes houses unfordable and unsustainable. The falling US dollar causes commodity prices to climb up in order to compensate underlying assets. Here we can see energy and material are still capable to move higher for months to come. Otherwise, the valuation for most stocks is too high to consider.

One area could also go up which is related to COVID-19 and vaccines.

In summary, it would be easier to hold up existing positions than adding new ones to the portfolio in today’s stalled market. Commodities in energy and material have chances to rise because of the dollar. Pay attention to some event-driven stocks and stay cautious at the record high zone.