January 12, 2022, 3:04 pm EST

Wild Bulls

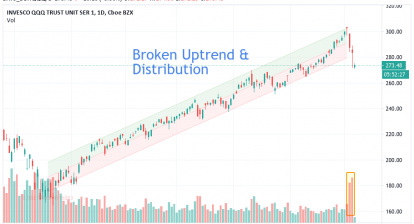

Wild bulls continued to show less predictable patterns since the beginning of 2022. Generally speaking, it is not a bullish signal.

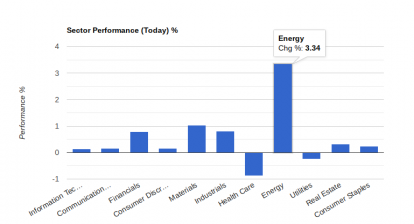

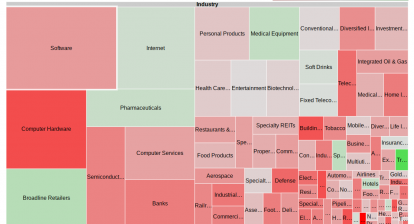

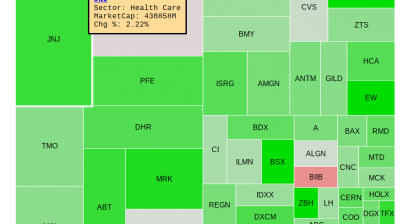

On the one hand, Inflation data on the Consumer Price Index that reached another 40 year high of 7.0 is a major obstacle for bulls to climb the uphills. On the other hand, inflation gave the energy, material, and consumer staples sectors a big boost. At the same time, mega technology and consumer discretionary swing up and down with the condition of COVD-19. Overall, it seems like the bulls are struggling at the late stage so that money rotates without consistent patterns.

Overall, it would be wise to stay cautious and conservative in terms of trading until more defined behaviors are presented.

We are still bullish on the following portfolio holding positions as they kept staying or making new highs under this environment:

- Bank: WFC

- REIT: PSA

- Cleaning Products: CLX

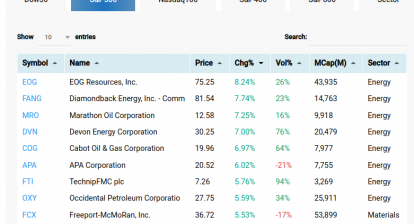

We are looking at the following sectors and stocks for your reference:

- Material: FCX, TECK, SCCO

- Energy: APA

Technically, the key level for the Nasdaq index is its 200 Day-moving-average line around 14711 which gave us the final judgment on the health of bulls.