June 27, 2022, 11:06 am EDT

Can the rebound become a rally?

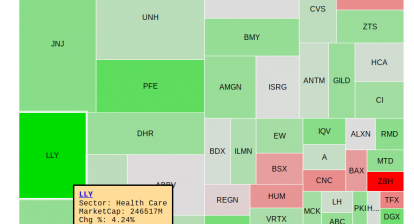

Last week stock market made a strong rebound between 5-7% gains for all major indexes that recovered about half of the loss since June 9, 2022. We may want to know whether this rebound can turn into a full-scale rally. Our view is negative. We think this is a short-term rebound and the downtrend will continue. But let’s first realize the reasons for this rebound.

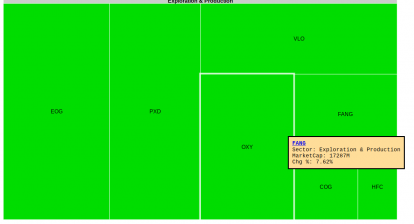

There are three main factors to make this rebound: Fallen commodities, re-opening of economic activities at post-COVID-19, and technical oversold rebound.

Fallen commodities last 1-2 weeks caused by the fall in the crude oil price (from 122 to 102) was significant to driving down all commodities. This is the most important factor that we need to keep following up in the coming weeks or months because it directly affects the inflation. If the oil price keeps falling, then inflation-sensitive data (CPI, PPI) may peak.

This summer is the first time re-opening of economic activities for the consumer after COVID-19 two and half years ago. Summer travel, vacation, dining, and shopping suddenly rising up significantly. Some market participants believe that consumer spending may revive the economy. We are highly suspicious about it because of the high inflation background. Yes, cruises, hotels, restaurants, and theme parks may do well this summer compared to the past two years. But, it is questionable to justify if this is a sustainable rally.

Lastly, the stock market drop about 10-12% before last week. So, the technical rebound is reasonable to expect. As our last article 06/23 indicated that it is at the first level of resistance. There are two more levels to overcome. In our opinion, it is unlikely to happen but we need to keep watching it.

In summary, the crude oil price is the most important factor to monitor. It directly affects inflation and the long-term development of the economy. If the oil price stabilizes and rises up again, the stock market will lose steam and resume its downtrend. If the oil goes down, then we will look at other factors again.