October 6, 2022, 12:06 pm EDT

Oil is Back

Gasoline price has a direct influence on inflation. Recently, the gas station shows higher price tags again to reflect both the wars and the OPEC+ reduction in oil supply.

Saudi Arabia and OPEC+ members decided to cut 2 million barrels of crude oil in order to boost the price to above $90 per barrel. Obviously, it slaps US President Biden’s failure to negotiate in increasing the volume in order to reduce the inflation pressure for the US economy.

It seems like middle East oil producers want to do the opposite.

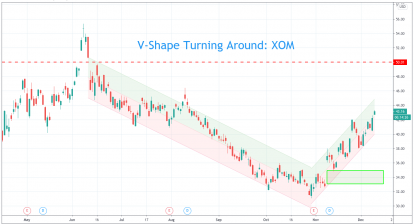

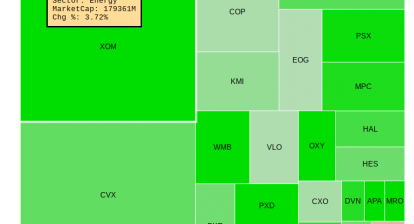

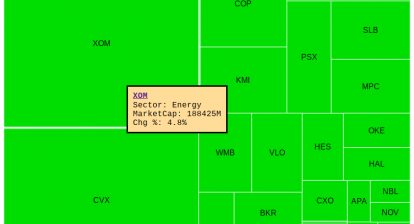

Checking out the chart of Exxon Mobil Corp (XOM) it is easy to see the oil is back in terms of price action. Instead of breaking down, XOM is back to the recent high of around $100 level. Technically, it forms a setup for a potential breakout of 4-month consolidation. Of course, many energy stocks are in a similar pattern.

From a trading point of view, energy stocks may be worthy of attention again. But, higher inflation seems to stay longer which is not a good sign for the US economy.