November 1, 2022, 3:40 pm EDT

Mega-Tech Equals Mega-Trouble

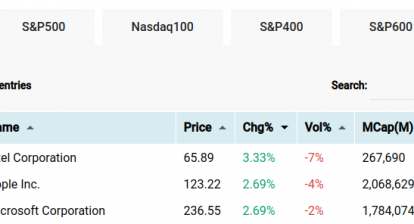

People used to refer the mega-tech companies as the points of attention due to their strong performance before 2022. These stocks include Amazon (AMZN), Google (GOOGL), Microsoft (MSFT), Apple (AAPL), and Meta Plafforms (META).

But these mega-techs are equal to mega trouble. For example, as shown, AMZN dropped 6% today for a new 52-week low. Other companions performed poorly also.

In our opinion, they will keep going down much lower for the bear market cycle as the leaders to the downside. They do not create any “Wow” factor for a long time. It does not matter whether it is an iPhone 14 or Facebook. The situation is even worse in the Meta platform (META) because it burns cash in a very fast speed. Its Meta verse is still in the dreaming stage. It will take many months or quarters to make an income or earnings.

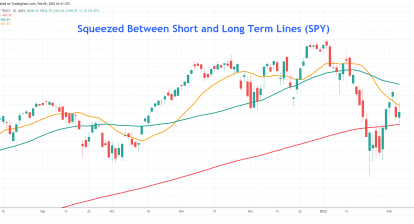

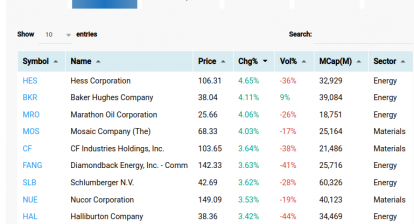

However, it does not mean the entire markets are in trouble. Energy, healthcare, industrial, and financial keeps up well since October. This rotation is important to watch because some stocks could perform well during the bear cycle if you are a good stock picker.

At this moment, avoid the mega-tech or Nasdaq index. Focus on the sectors mentioned above you will still have investment opportunities available.