November 2, 2022, 11:06 pm EDT

Red Carpet After The Rate Hikes

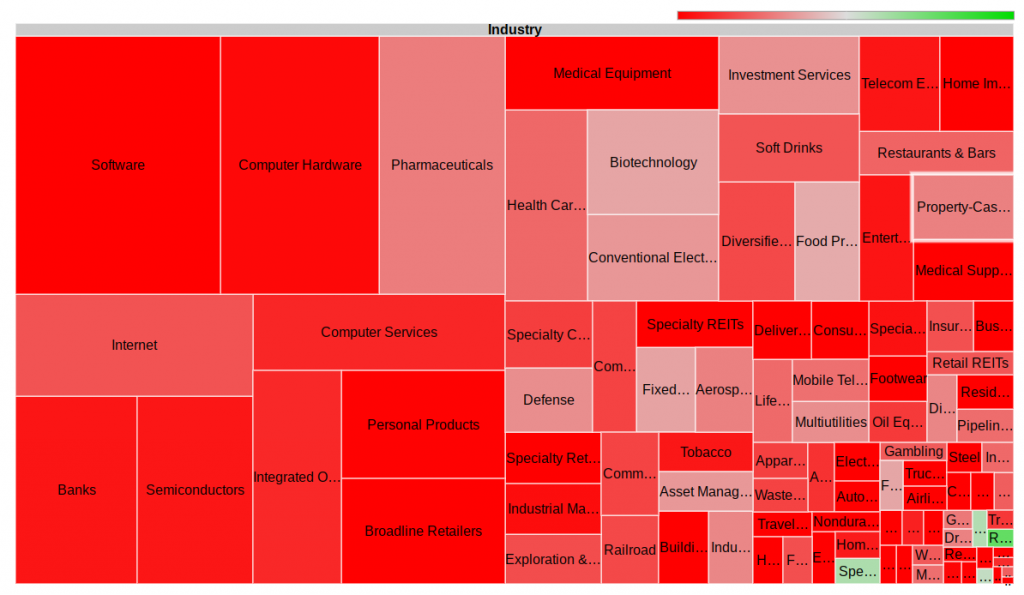

The stock market shows the red carpet after Fed adjusted its Fed fund rate to another 0.75% to 4% which made up the 6th rate hike for 2022.

All big six lost another 3-5% (AAPL, AMZN, GOOGL, MSFT, TSLA, META) with majorities of others. The message should be clear: “Do not fight with Fed”.

We think the rate hike process will continue in2023. Some people think Fed may slow down its pace in order to keep the economy alive. It is a very optimistic view in our opinion. Having a solid oil price of around $90 per barrel and a strong US dollar, the inflation is likely to stay longer.

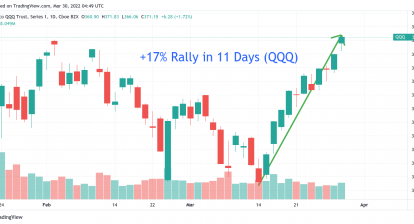

Technically, the strong rebound in the past couple of weeks may hit a ceiling. Dow jones failed to hold on to 200 day-moving-average (DMA). S&P was unable to keep its 50 DMA. More importantly, Nasdaq cannot hang in 20 DMA. It looks like Nasdaq is ready to fall further which will open up the possibility for a new local low below 10088.

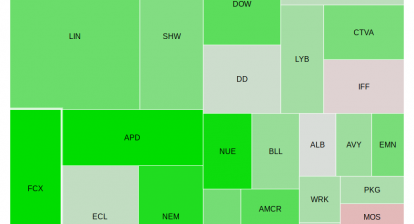

Only a few Dow Jones components may hold up. Thus, staying cash might be a good choice for this market.