March 18, 2023, 1:15 pm EDT

Gold and Silver For Uncertainty Time

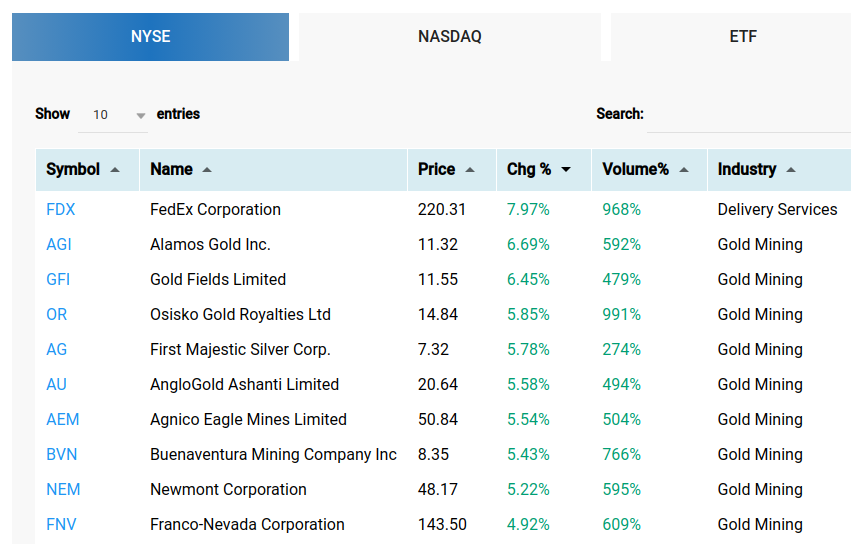

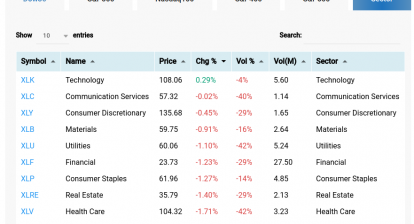

Gold and silver metals stood out in the crowd in the stock market when unknown fear arrived. It is easy to spot this momentum when you see both price gains and outstanding volume behaviors as shown in the featured table from the industry ETF table.

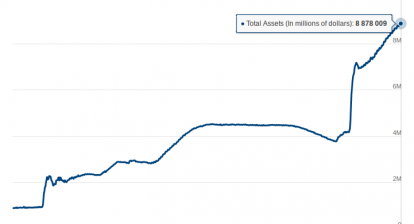

Indeed, the past two weeks carried much bad news from banks closure (Silvergate, Silicon Valley Bank, Signature bank) and bank rescue (Credit Suisse bank). Furthermore, unstable geopolitical environments (Russia, Ukraine, US, China, Korea, Japan) seemed to sharper the confrontation. Without knowing what would happen in the coming weeks, some investors began to accumulate the precious metal: gold, and silver in their portfolios. When both price and volume spike up together, investors are exposed to the need to get them heavily and quickly.

It is common sense that gold and silver would keep their value during tough times compared to other stocks. Also, they work well to fight inflation. Here are some gold and silver stocks and ETFs for reference.

- Gold: NEM, GOLD, AEM, FNY, HMY, KGC, AGI, GFI

- Silver: PAAS, AG

- ETF: Gold Price 1/10 (GLD), Gold Miners (GDX)