April 10, 2024, 10:14 am EDT

The Stubborn Inflation and Breakout of the Yields

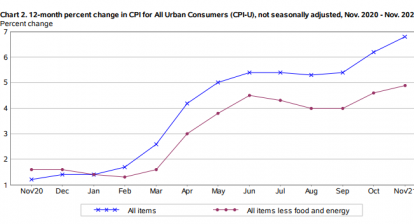

The CPI report was released today to show a 0.4% increase for March and setting the 12-month inflation rate at 3.5% which is 0.3% higher than expected. It should not be a surprise but this confirmation eliminated the hope for lower rates in 2024.

This stubborn inflation number boosted the yields to another level out of consolidation in the past few months from the bottom. Currently, the breakout and follow-through gave 10 years treasury yields reaching 4.5% level today as shown.

It could mark April 1, 2024 as the absolute top of this aging bulls if the stock market cannot recover.

In our opinion, geopolitical conflicts, US-China tension, and Middle East unease are unlikely to resolve in the foreseeable future. In this background, the stock market will encounter a tough road ahead battling inflation, higher rates, and slow growth.