January 24, 2024, 8:08 pm EST

Narrow Market with Fewer Pillars

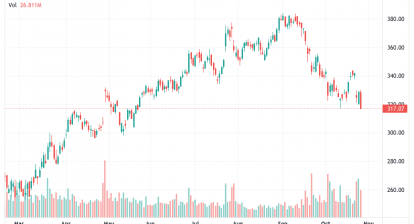

The stock market has been strong since late October 2023. This year S&P 500 and Nasdaq spiked even higher for many record-high milestones. However, it is a rally with a few stocks.

Only a handful of stocks took the major indexes to a new high. These stocks are very large in terms of market capitalization so they took a lot of weight representing the indexes. Here is the list of the stocks:

| Company | Market Cap | 1 Year Returns |

| Microsoft (MSFT) | 3 Trillion | 66% |

| Apple (AAPL) | 3 Trillion | 36% |

| Amazon (AMZN) | 1.6 Trillion | 63% |

| Google (GOOGL) | 1.8 Trillion | 52% |

| Meta (META) | 1.0 Trillion | 173% |

| Nvidia (NVDA) | 1.5 Trillion | 218% |

| Tesla (TSLA) | 0.66 Trillion | 44% |

It should be easy to see these technology caps drove up the indexes but most other stocks did not participate in the rally. Therefore, it is a narrow market.

Although they are powerful enough to lift the entire index with even seven of them, the danger part is that they could also drag the index to the downside quickly when they change direction.

For example, Tesla (TSLA) gave a disappointing earnings report after the market closed today. Its stock dropped about -6% immediately. The stock market could feel the negative impact tomorrow.

How about if other brothers also suffer during the earnings season?