September 30, 2021, 11:40 am EDT

Supply Chain Interruption

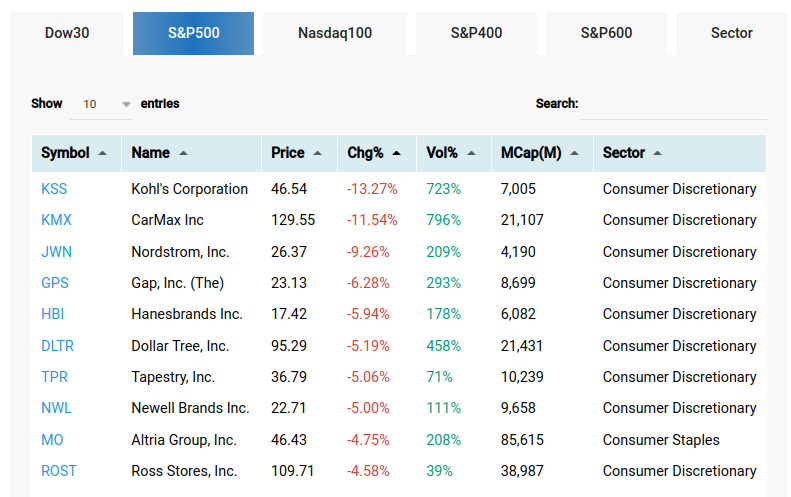

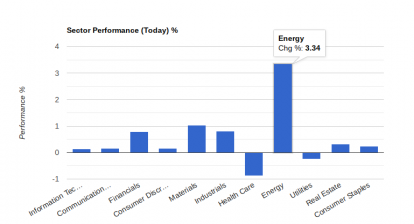

Supply chain interruption is fatal to retailers or the consumer discretionary sector. As shown in the featured table, we can see the falling list is full of retailers today. Bed Bath & Beyond (BBBY) tumbled -23% to show retailers are struggling to survive.

Influenced by COVID-19, global shortage of workers, series shipping issues, shortage of components, and skyrocketing material cost all contributed to the problems that retailers faced. In addition, China shut down power supply in many regions, adding another headache to worldwide distributions that relied on China products.

As mentioned in the September 14 article The collapse of China Evergrande Group, it simply opened up the cans to let all bugs come out when US stock markets were still at record high levels. Reopening of business may help the US economy a little bit but we have to look at the big picture.

In our opinion, the bubble bursting process would start from China, then quickly spread to the US, Europe, and Japan. It could become the worst nightmare even seen.

Overheated housing markets, over-capacity manufactures, over-supplied paper money, overburden debt (household, business and government), worked together to create the largest global bubble ever.

Today, this supply chain interruption could be another warning signal to remind us to look at the bigger picture on global economic conditions. Of course, it does not mean we need to panic and sell all stocks with an empty portfolio. Because there are still stocks which will do well during the bear markets. We just need to prepare for it.

anthonycar

great points made here!