Markets

Overall market condition including stock markets, commodity, global markets, bond, currency markets, etc.

Rebound Over. Red Color Again

04/01 6th day rebound is officially over today when all major indexes drop about -4% as of now. All S&P sectors are in deep red again. Consumer staples behave the best like Dow only components Wal...

Low Volume Down Day After Three-Days +23% Gains

03/27 Volume is on low side for all sectors, as shown. Although major indexes pullback -3% as of now, it is small portion compared to +23% gains in the past three record days since 1931. Therefore, re...

Rebound: The Third Day

03/26 2 trillions stimulus approval gives stock market the third day of rebound. All green colors covers all sector map. However, volume is on average scale. Also, High percentage gains come from airl...

Second Day Rebound

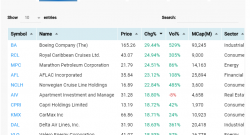

03/25 Rebound enters into second day with 5-6% on DJIA and S&P and 2% gains in Nasdaq. Leading stocks are among beaten down stocks in energy, retailers, airliners, hotels, etc as shown. Laggards a...

QE Infinity = Power Infinity

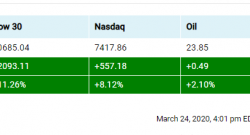

03/24 QE-Infinity brings another record stock markets day with DJIA +11.4%, S&P500 +9.4% and Nasdaq +8.1%. Maybe upside momentum can bring stock markets even higher for this week or next week. Bot...

Trillions Stimulus Coming

03/24 Hope for trillions of stimulus plan injects fuel for +1700 points on DJIA. Rally is across-the-board from deep down hotels, cruises to energy, oil to technology network and semiconductor all par...

Oversold and Overbought

03/19 Obviously, markets need to balance out overbought in consumer staples and healthcare and oversold in energy and consumer discretionary. Overall condition is still weak. There were many actions f...

Markets Keep Plummeting

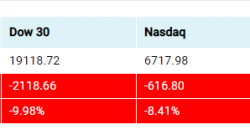

03/18 Stock markets, oil and commodities keep plummeting in fast speed that trigger circuit breaker of -7% about 30 minutes ago. There is no technical support after S&P crossed down 2350. So, next...

Healthcare and Consumer Staples Sector Leadership

03/17 It should be easy to see from Index Map that healthcare and consumer staples take leadership roles while markets rebound mildly today. In Dow Jones index, Healthcare care includes JNJ +5%, PFE +...