June 25, 2020, 10:55 am EDT

Markets Struggle

Whenever there is a drop in the stock markets, there are two sources of power come in to save and boost the markets. There are government or policy makers and bargain buyers. If the sell-offs are accompanied with high volume and rebound in low volume, it means that both actions are going to fail. This is the key observation point.

Today, the Federal Deposit Insurance Commission announced it would lose its banking regulation called Volcker rule. It intends to help financial institutions to lend or invest its money to industries.This action could free up billions of money from banks to areas who need money.

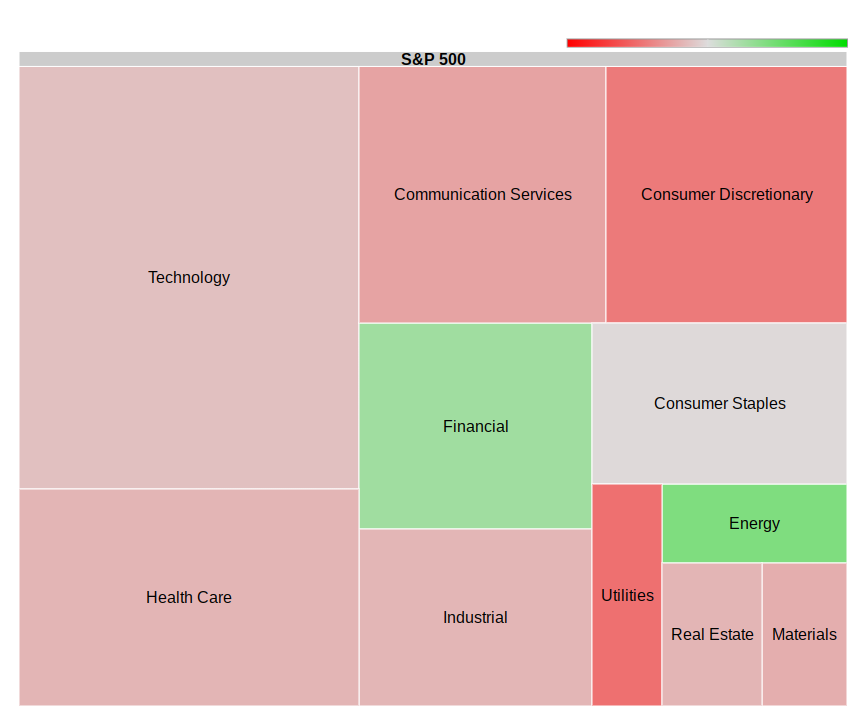

This is the background why financial (XLF) and energy (XLE) sectors are both up +1% this morning.

It may be a good intention to save the stock markets after yesterdays’ -700 loss in DJIA and above -2% across all major indexes. However, it is important to know such actions may not work at all.

Stock markets have been manipulated by the government, Fed and Wall street to an overvalued status with both trailing P/E and forward-looking P/E to above 21 levels for the S&P index during the past 3 months. Major indexes are up near 45-50% from March bottom.

Thus, market participants should be aware of differences between trend change and minor news influence.