May 12, 2021, 7:39 pm EDT

Inflation Era Smashes Stock Markets (CPI)

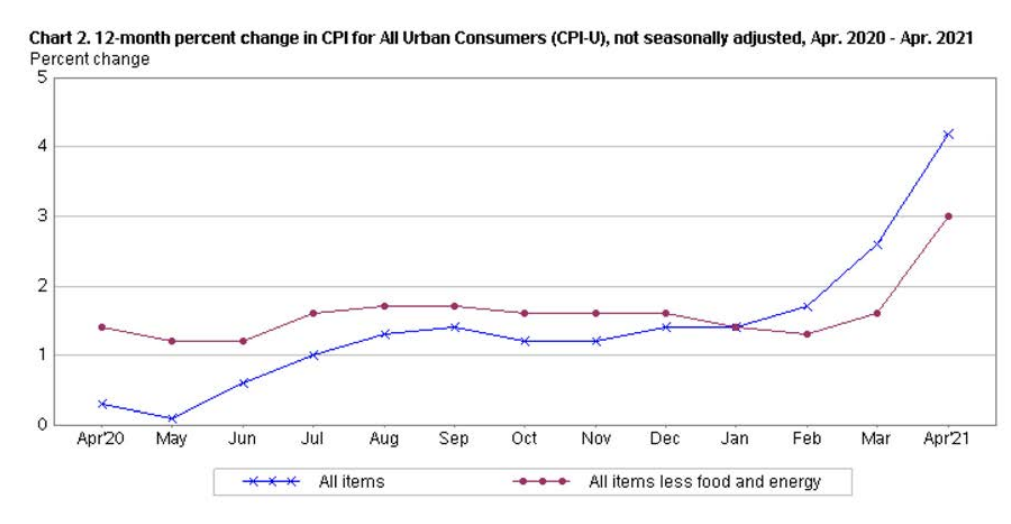

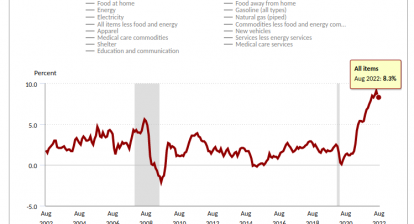

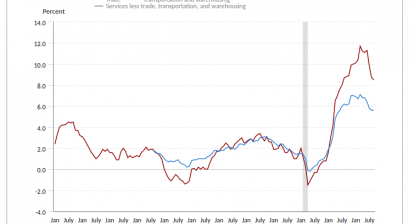

The time has come. High inflation data arrived today with a CPI +4.2% increase for the last 12 months that is the largest one after September 2008.

“The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.8 percent in April on a seasonally adjusted basis after rising 0.6 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 4.2 percent before seasonal adjustment. This is the largest 12-month increase since a 4.9-percent increase for the period ending September 2008. “ —Bureau of Labor Statistics

There should not be a surprise to anyone since we all know it from gas station to supermarket that prices were up significantly for more than a year. Stock markets simply need to face the reality that borrowing costs will rise up with higher interest rates. Homebuilders, retailers, consumer-related industries, semiconductors,s, and almost all technologies were hit hard today. Only energy and healthcare were able to keep some green colors. DJIA was down -2% or about -700 points and Nasdaq lost -2.7% today.

The impact of inflation should be emphasized because it could be the turning point or termination of 12 years bull market. If this is the case, we can mark 05/10/2021 the final top of the Dow Jones index that will stay there for years to come.

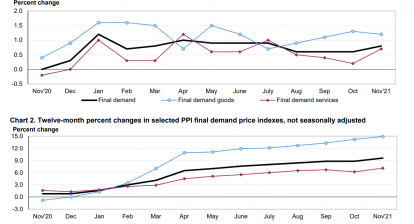

US government and other major financial institutions (Euro, Japan, China) were printing enormous amounts of paper money for stimulus, COVID-19 job loss, and many easing policies. The consequence is coming.

It should be time to scale back portfolio settings with fewer positions. Focus on foods, commodities, healthcare, REIT, utilities defensive types of holdings.

Major indexes were up about 80-90% in the past twelve months which is way too much for normal markets. Sharp sell-off and deep pullback are all possible to digest the gains. Thus, please be ready to handle it.