November 12, 2021, 7:46 pm EST

Market Direction

Weekend Review

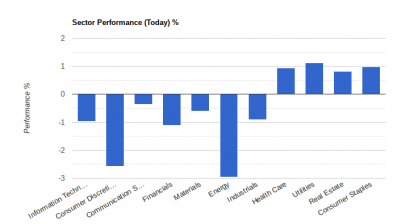

The stock market experienced a roller-coaster week with a few down days and up days. By the weekend, the overall tone is still very bullish by the Friday performance: DJIA +0.5%, S&P 500 +0.7%, Nasdaq +1%.

The inflation threat is evident by the October Consumer Price Index +6.2% that was the direct cause of some selling pressures. But, bears did not have enough power to continue punching the indexes. Thus, the entire stock market recovered very well. In addition, there are some bullish spotlights that reinforce the bulls.

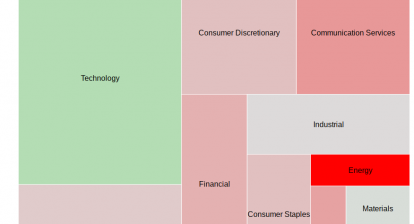

First, all offensive sectors behaved very well including technology, communication, and consumer discretionary.

Second, the following industries and stocks made strong gains this week:

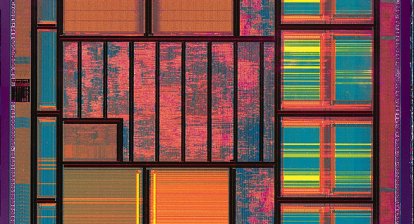

- Semiconductor: STX, XLNX, AMAT, WDC, MU

- Software: MSFT, SHOP

- Internet Retail: ETSY

- Network Security: DDOG, S

- Home Builders: DHI, TOL, CVCO

- Recreational Products: POOL

- Household Products: WHR

- Automobile: GM, RIVN

- Metals: FCX

- Building Materials: TREX

Lastly, rebound from mega-caps FB, GOOGL, AMZN, AAPL, NFLX made the drop earlier this week a minimal impact.

In summary, stock markets hold up well so we will keep looking for candidates for the watch list and portfolio next week.