February 16, 2022, 9:43 pm EST

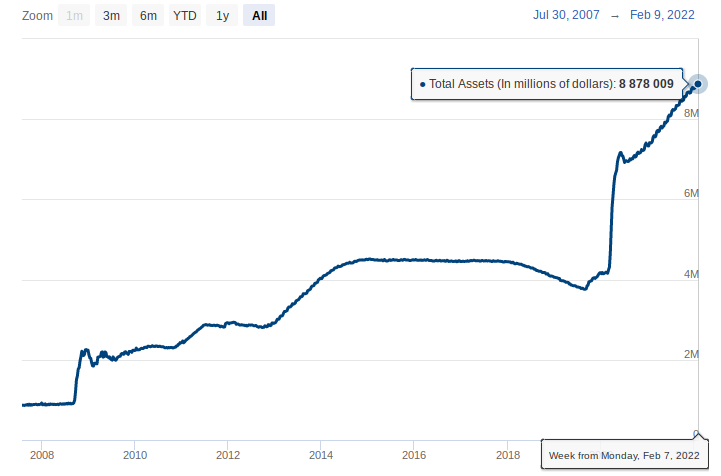

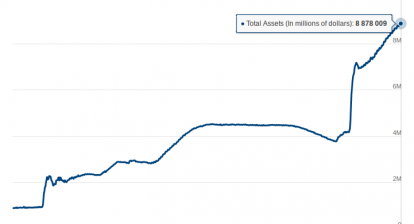

Balance Sheet Reduction

Do you need to worry about your credit score if this chart is your debt level? Most likely, the FICO score would not look pretty if the balance shot up from about 1 trillion to near 9 trillion in 4 years. This is why Fed is trying to reduce the balance sheet after confirming that inflation is out of the comfort zone of 2% as the FOMC meeting minutes revealed today. The rates are going to get higher in March together with balance sheet reduction.

The statements did not state any other more aggressive actions so the stock markets were cheered up for a few hundreds of points in Dow Jones. All indexes ended up with about flat in low volume. Therefore, there is nothing special movement today.

Our viewpoint remains the same that bears are likely to take more control of the stock markets for the months to come. Rasing rates and balance sheet reduction contribute the main factors for it.

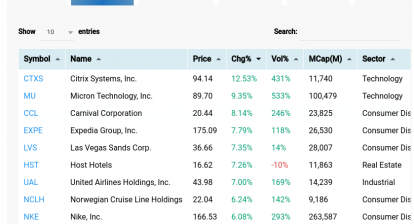

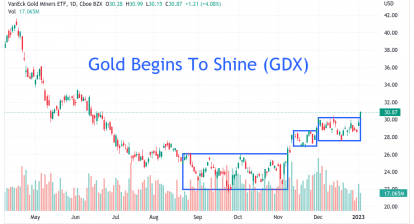

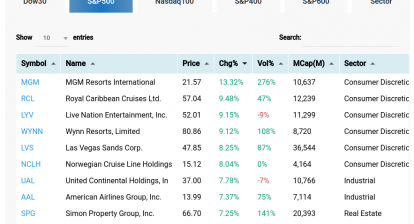

There are still investment opportunities during this period as markets had shown:

- Material: GOLD

- Travel: BKNG, EXPE

- Hotel: HST, MAR

COVID-19 improvement seems to provide an optimistic view about the future. But, the economic data warns us to stay cautious and alert at all times.