Bearish Outlook

Last Friday’s sell-off triggered by the statements from the Fed Chairman Jerome Powell indicated a very bearish outlook for the stock market.

Economy

In order to bring down inflation, a certain price needs to be paid by dimmer economic activities in the job markets. Also, rising rates are the solid answer to cool down the red-hot housing markets. In fact, the housing market has already begun to show signs of trouble in the sales and prices. We will monitor both job markets and housing markets to fall further from the current level which will bring down the stock markets for sure for the next 6-12 months, in our opinion.

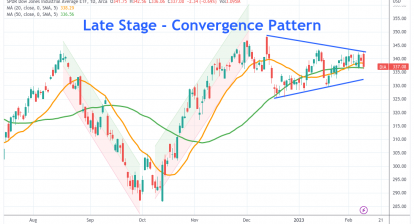

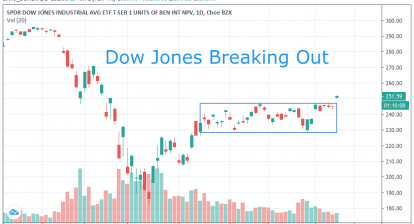

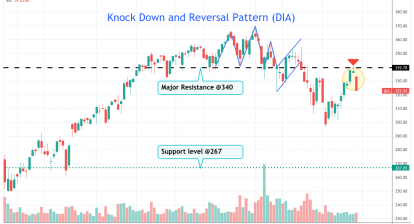

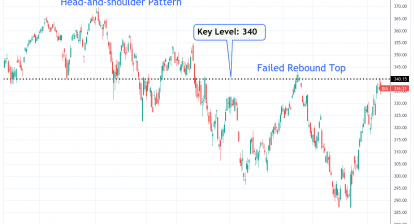

Technical Analysis

Technically, we can see a knock-down and reversal pattern for the Dow Jones ETF (DIA) as shown. Level 340 became a major resistance for DIA where it would be difficult to overcome. The downside momentum could bring DIA to 300, the previous low. But, the real support could be at 267 level as marked.

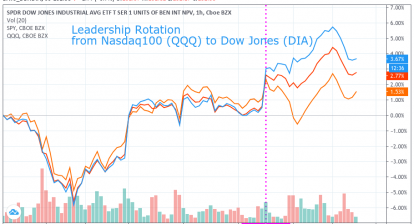

Market Leadership

The weakness of the aggressive mega caps like AAPL, AMZN, MSFT, GOOGL, META, NVDA, and TSLA is another watching point to witness the retreat of bulls. Only possible leaders could be in the energy and material sectors.

Risks

The Russia-Ukraine war and the US-China confrontation are major risks to watch. Currently, it seems like the troubles are getting bigger, not smaller.

Strategy

The trading and investment strategy for this type of market condition should be geared toward conservative approaches. It means holding fewer positions in the portfolio and avoiding frequent tradings. Furthermore, keep looking for additional positions in the energy and material sectors that are the only place for an upside move.