February 1, 2023, 7:14 pm EST

Offensive Swing

Today the stock market made a wild swing as a reaction to Fed’s meeting with another 0.25% rate hike. The Fed fund rate reached 4.5% – 4.75% as the result. The Dow Jones index swung more than 700 points (intra-day high: 34334, intra-day low: 33581).

The main question for the rate hike is whether the process is near the end. The tightening process started in March 2022 when the rate was 0% – 0.25%.

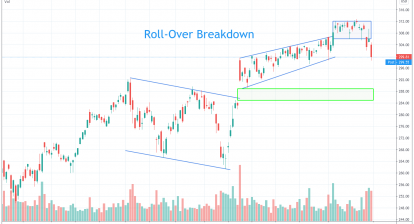

If the tightening process is near the end, then the stock market is ready to climb higher again because it means that inflation is not a big problem. Also, the quantitive easing policy will boost the stock market for higher ground as we witnessed in the past 14+ years.

Some market participants believe that inflation peaked out already. Market-friendly Fed could stop the rate hike soon (probably one more hike only). Then, Fed could adjust it down again which is a powerful weapon to drive up the stock market.

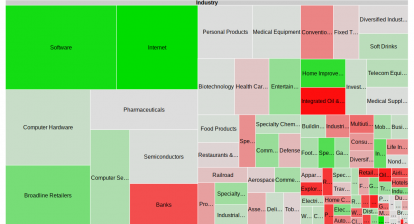

Therefore, we saw today’s reaction is both offensive and aggressive to the upside. Although Dow Jones stayed flat, S&P got +1% and Nasdaq achieved +2% gains. After hours, Metaverse (META) release its earnings report that its stock price shoot up nearly 20% in extended hours trading.

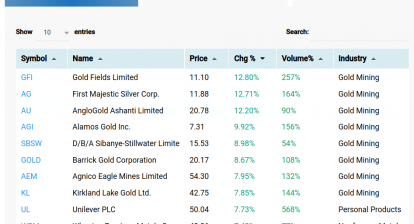

Furthermore, the semiconductor industry jumped up more than 5%: AMD +13%, WOLF +9%, NVDA, MRVL, AMAT, GFS, MPWR +7%, TER, LRCX, ON +6%, etc. It should be a good idea to add some positions in the semiconductor industry in our opinion.

Overall, the market made an offensive move.