April 20, 2024, 11:33 am EDT

Do Not Chase the Red-Hot (XOM)

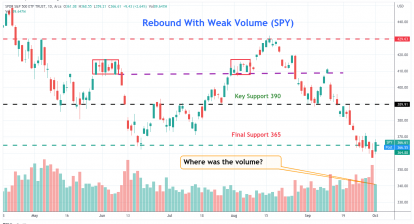

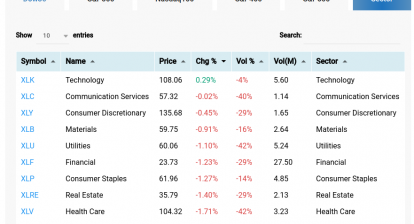

It has been a couple weeks after the stock market reached the all time highs around April 1, 2024. But, many market participants smelled the potential bear markets after brutal drops of the major leaders in the past.

For example, Apple (AAPL) and Tesla (TSLA) which led technology and Nasdaq in the past few years with outstanding fundamental, technical, and performance inside out. They are at 52-week low as of now. AI daring chip makers Nvidia (NVDA) and AMD (AMD) drop -10% -5% yesterday. Super Micro Computer (SMCI), whose stock price climbed from 250 to 1,200 (January to March 2024), collapsed with -23% on Friday.

But, few mega tech companies remained strong before the coming earnings: AMZN, MSFT, GOOGL, META. Their fate will be revealed soon.

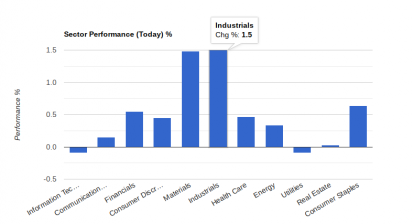

This rotation reminds us that do not chase the leaders after they make the run. Doing so could cost the traders or investors a lot as the stock would drop much faster.

Our strategy is always to look at the big picture and wait for the moment of entry. The ideal entry point would be a proper base and setup for its uptrend.

Here is an example of our trade on Exxon Mobil Corp(XOM) that we mentioned in our 02/16 article.

Our entry point on 02/15 is justified by its performance now. Fundamentally, Middle East conflicts between Hamas-Israel expanded to Yemen, Gaza, and surrounding regions. Recently, the attack and retaliation between Israel and Iran were manifest. Obviously, it could give energy suppliers an opportunity because the shortage of supply may arrive during wars. Technically, we can see from the featured chart that a two-month bottom base (December 2023-January 2024) and two weeks setup for breakout are our favorite pattern.

Currently, we still hold XOM position with about 15-16% unrealized gains. When we realize that other people holding their AAPL or TSLA positions in red color in the portfolio, we feel that investment should cut the loss quick and hold the winner longer. They try to comfort themselves by hoping TSLA will have AI/robots in the future which could turn around TSLA.

Well, nobody knows the future. It would be better to understand what happens now and what is the best action to protect the capital and profits.