February 20, 2021, 7:41 pm EST

Stock Market Weekly Review: Market Strength and Status

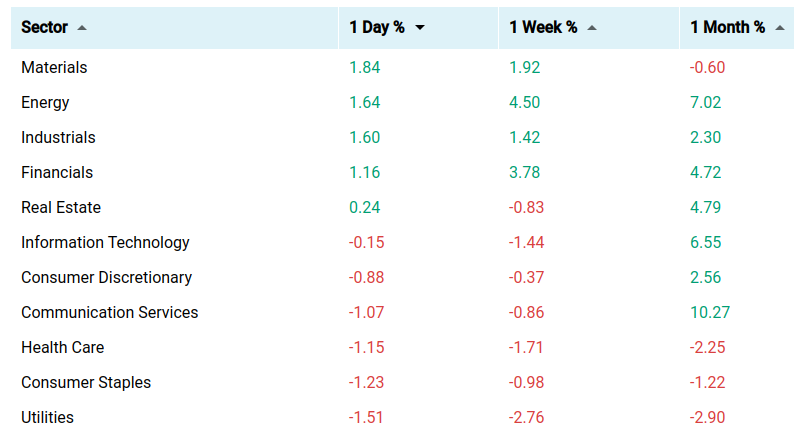

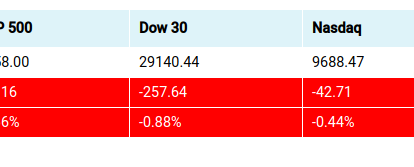

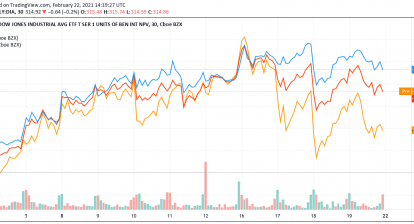

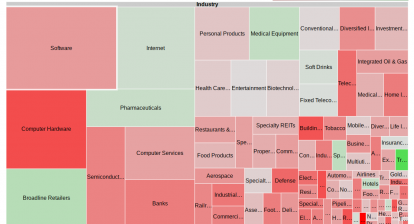

DJIA +0.11%, S&P -0.71%, Nasdaq -1.57%, this is the past 5 days index performance. We can see strength moved from Nasdaq to Dow Jones. It is easy to see this behavior through Apple (AAPL) and Tesla (TSLA) stocks as examples. If these conditions continue, then we can see more rotation takes place shifting from red-hot technology to core sectors.

Core sectors include industrials, financials, materials, and energy. Please check the following stocks in each sector in terms of their stock performance. Then, it should be easy to convince that many investment opportunities are there.

- Industrials: CAT, GE

- Financials: AXP

- Materials: FCX

- Energy: XOM

Other areas with strong performance are china stocks and consumer discretionary.

- China: BIDU, PDD, JD

- Consumer Discretionary: MAR, GOOS, H, LVS, RCL, CCL, NCLH

However, it is important to note that volume kept declining for the past 3 weeks with uptrend and stalled actions. It spells out exhaustion on bulls at record high areas. Indeed, slow growth on jobs and high expectation on stimulus made this rally into a certain bottleneck.

In summary, there are still stocks that can go up when stock markets are going through rotation. But, traders and investors should be aware of current market status which is a straight up 3-4 months non-stop rally. Any type of pullback is possible.