November 25, 2022, 8:23 pm EST

Investing in Fancy Technologies

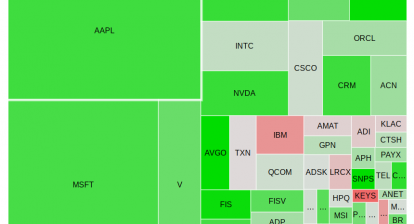

Fancy technology products could be attractive on your shopping list like Tesla (TSLA) electric cars or Apple (AAPL) iPhones. But, investment should not be based on brand names. The criteria should be based on its fundamental (earnings, sales, valuation, etc), technical (trends, patterns, etc), and news (outlook, status, etc) analyses. Investing in these two fancy names: TSLA and AAPL could be highly risky and could result in a loss even though they are already down -50%, -16% for 2022. In our opinion, they are lots of space for them to dig their basement for 2023.

Tesla (TSLA)

There are many reasons that TSLA could go down further from the current level of 182. First, TSLA is bundled with Twitter for their future together. Now, Elon Musk is the CEO and owner of both companies. He has to sell TSLA shares to save the dying black hole on Twitter. Nobody knows whether Twitter can someday make a profit of one cent. Thus, the future of TSLA depends on the success of Twitter. At this moment, Twitter does not look good at all. The second major issue of TSLA is its super high valuation of P/E ratio 56. Even though it was down from the triple digits in earlier months, it is still too high compared to competitors Ford (F) or GM (GM) around 6. During the bulls cycle, a high P/E is acceptable with high growth. But, a high valuation is fatal to investors during the bear cycle which is the months or years TSLA has to face. Lastly, a China factory in Shanghai may encounter a production issue due to the COVID-19 lockdown. The political environment in China does not favor both TSLA and AAPL.

Apple (AAPL)

Apple may need to resolve the challenge of production shortage for its advanced iPhone model iPhone 14 Pro. Its factory in China is undergoing a COVID-19 shutdown and protest that will impact its production and delivery for the holiday season. Furthermore, the demand for its iPhone is already weak. Both factors would squeeze its Q4 topline (sales) and bottom line (earnings) in our opinion. The second issue is also its high P/E of 26. Apple does not have any new features or revolutionary changes for its iPhone, iPad, Mac, or iWatch for years. It is hard to justify how could it still have such a high valuation. During the bear markets, it is another major threat to this global technology brand.

The time has changed. Both TSLA and AAPL used to be the stocks people loved. But, we think they are no longer the leaders in the stock market in terms of their performance. Moreover, their futures look pale.

Investment should not be based on past performances or common impressions. We will avoid these names in our watchlist and/or portfolio. We pick stocks according to the bull/bear cycles and other conditions not based on the names.