June 30, 2023, 9:16 pm EDT

Halftime Report of 2023

What a marvelous finish to the first half of 2023 in the stock market. The strong performance was made under the wars, inflation, and COVID-19 recovery. We will summarize it and look forward to the coming second half of 2023.

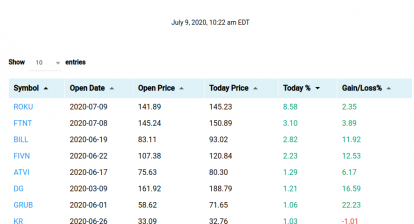

Scorecard

Here is the Year-To-Date return of the major indexes:

- Dow Jones: +3.8%

- S&P 500: +15.9%

- Nasdaq: +31.7%

- Nasda-100 (QQQ): +38.7%

There is no doubt that this result surprised most people. If anyone knew this, they will put most of their cash into QQQ where a nearly +40% return is the unbeatable outcome. Thus, the conclusion of the stock market performance is A+.

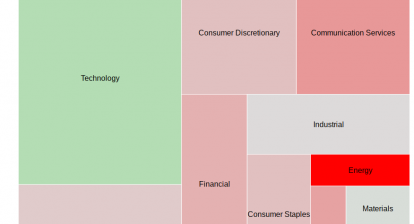

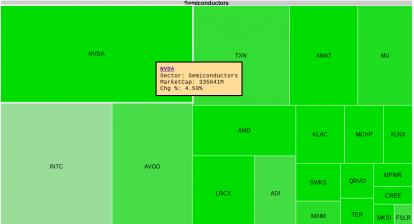

Winners

Mega-techs dominate the leadership roles: AAPL, AMZN, META, GOOGL, NVDA, AMD, SMCI, PLTR, and TSLA. Amazingly, NVDA made +190% gains in 6 months. Other winners include home builder TO. PHM, streaming NFLX, SPOT, ride UBER, and cruises RCL, CCL, etc.

Losers

Losers include bio-tech MRNA, BNTX, retailer DG, ETSY, BURL, EL, finance SCHW, USB, oil APA, drugs CVS, and China PDD.

Background

Post-COVID-19 reopening contributed to the success of airliners and cruises. AI displayed its power and potential hosted by ChatGDP that crowned semiconductors, software, internet, and social segments. The retreat of inflation injects more hope in homebuilders.

Surprisingly, Russia-Ukraine and the sharp relationship between US and China did not drag the stock market at all. Bank failures like Silicon Valley Bank, Signature Bank, and The First Republic also did not bring much damage to the overall stock market. Also, high-tech layoffs earlier this year were limited to technology and few other retailers. The booming job markets withheld the impact. Federal Reserve may add another 0.50% to its rates by the year’s end. At this moment, the market reacts calmly. Lastly, the inflation and rising rates became less noticeable under the strong permanence of the stock market and job markets.

Outlook

All the above risks like wars, global economic slowdown, and inflation, would carry over to the second half of 2023. Thus, it is important to stay alert if any event magnifies the troubles. However, the stock market could also absorb various kinds of headwinds and move forward as we saw in the first half of 2023. So, we have to keep investing and bearing a cautious mind ahead.