February 26, 2021, 12:33 pm EST

Bye February

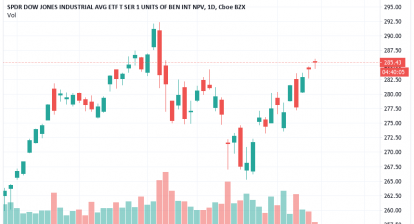

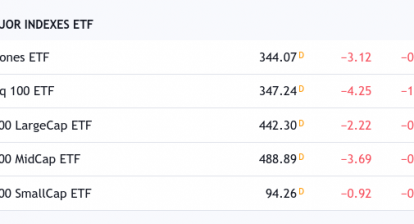

Today is the last trading day of the month February. Stock markets reacted with a mixed performance where DJIA mild loss (-0.4%) and S&P 500, Nasdaq rebound stronger +0.6%, +1.6%.

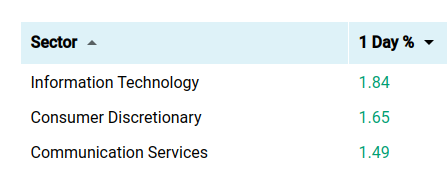

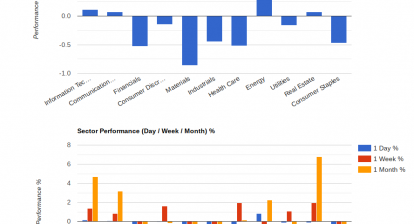

Today’s leading sectors include technology (MU, AMAT, FB, NVDA, AAPL, MSFT), consumer discretionary (ETSY, LB), and communications (FB, TWTR, CHTR).

It is important to note that Nasdaq is losing its 50 day-moving-average line or technical intermediate-term support. So, overall technical damage to Nasdaq is still there as the remark for February.

March is a special month of the year because many bulls and bears’ top-bottom occurred in March throughout the past 120 US history. While Nasdaq made about 100% from March 2020 to February 2021 within a year, it is essential to be extra cautious on a pullback or any sort of sell-off or reversal. After all, it is extremely extended markets for all indexes that made 60%-100% within a year of shut-down, closed stores, and layoffs.

In other words, markets are ahead of reality because of a high amount of stimulus or money printing and a man-made low-interest-rate environment. There will be a consequence like inflation, housing bubbles or difficult time ahead. It is better to prepare for it.