May 18, 2021, 8:44 pm EDT

Dollar Falls

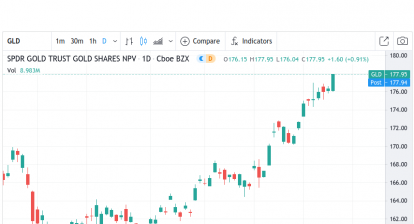

The US dollar kept falling to near 2021 low as shown. Once it breaks this level, it could open up another major downtrend. It is a direct result of the oversupply of the US dollar. This is why commodities (oil, natural gas, steel, copper, aluminum, lumber, foods) keep rising. Eventually, the falling dollar will cause major inflation and terminate economic growth.

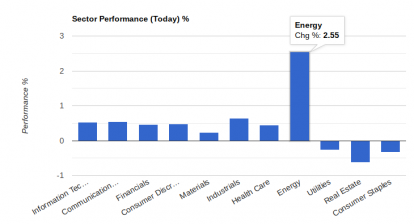

We are near the turning point or the peak of the stock markets, near record-high levels. Housing markets are the same. Super hot housing markets make houses less affordable. Thus, it should be time to scale back on investment for offensive stocks except for commodities and some defensive industries like food or the consumer staple sector.