June 21, 2021, 2:23 pm EDT

Strong Rebound from the Core Sectors

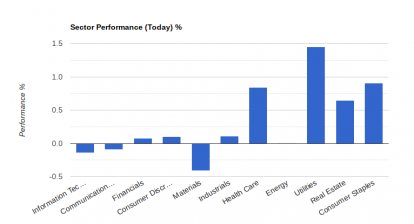

It is a surprisingly strong rebound for DJIA with +550 points that recovered last Friday’s drop. Core sectors, Energy, Material, Financial and Industrial, lead the rebound power. Dow Jones index is still a distance from the new high but S&P and Nasdaq are near new record highs area again.

Interpretation of Fed’s statement last week was the main point on the market reaction. If inflation comes too fast that forces the Fed to adjust its policy much earlier (2022) by reducing bond purchase, raising the Fed Fund rate could hit housing markets hard. Or, it could be a strong economic recovery with mild and short-term inflation where the stock market can keep going on further.

Last Friday’s market reactions seemed to be pessimistic. Today, it flips its thought to believe the other scenario.

Needless to say, it only brings more confusion to the market participants on what to do for the second half of 2021. Although we do not have a crystal ball to predict the future, there is still something we can do.

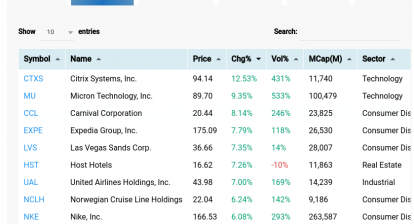

First, keep watching recovery-focus stocks that will carry strong earnings because of reopening. It assumes COVID-19 is under control and vaccines are effective.

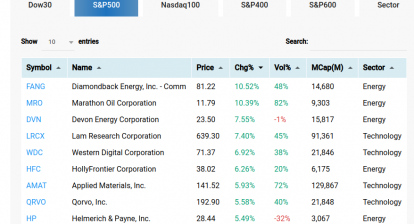

Second, keep commodity stocks (Ex: energy) if the inflation is getting higher and quicker.

Third, hold up REIT, food, and defensive stocks in case of a sudden drop when certain events occur (Ex: bad economic numbers CPI, PPI, housing, jobs).

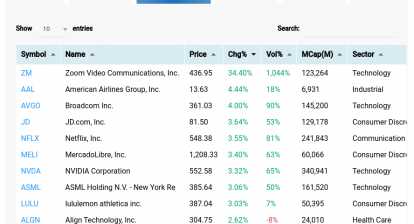

Lastly, watch if any emerging stocks from the offensive area (Ex: technology).