November 10, 2021, 11:44 am EST

Consumers Feel the Heat

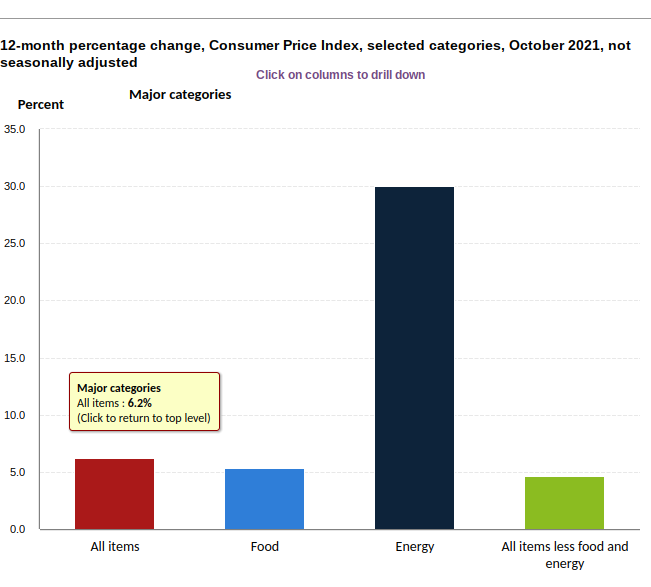

Consumers should feel the heat of rising prices from gasoline, milk, egg, or almost anything essential for a living. Consumer Price Index hits 30 years high of 6.2% year-over-year according to the US Bureau of Labor Statistics as shown.

US keeps spending as fast as possible including the latest bills on a $1 trillion dollar infrastructure in order to combat the economic slowdown caused by COVID-19. In the past two years, the US government gave many checks to citizens and corporations when businesses were shut down. In addition, low-interest rates policy and bond purchase programs keep the house prices to the record high ground. It seems to work to bypass the trouble from this fatal disease. But, the consequence is coming as hyperinflation for the price increase everywhere.

There is no easy solution to this problem. We expect that energy, material, food continue to rise by 2022. More importantly, precious metals, gold and silver, may be ready to join the rally as we mentioned recently. Gold miners ETF GDX is up +2.5% for the fresh 3-month high for this reason. It should be worth following for the further development of precious metals.