January 1, 2022, 3:19 pm EST

The Outlook of 2022

Today is the first day of 2022 so let’s take an outlook of the stock market and economic status to prepare for investment strategy and portfolio settings.

Big Picture

The stock market performed very well in 2021 (DJIA +19%, S&P 500 +27%,, Nasdaq +22%). Also, all indexes stayed at near-record highs area so the bias must be bullish from the price actions. However, looking closer to its decline breadth readings, distribution volume pattern, lack of broad leadership, and rising defensive sectors, there are cautious signals to keep in mind for 2022.

US Economy

From the US economic policies point of view, tapering and rising rates are going to happen quickly that is the very important signal that the tightening process is going to start. More importantly, the tightening is not driven by an overheated economy. Rather, Fed is forced to take action due to hyperinflation on almost all commodities (gasoline, food, etc). The higher rates mean higher borrowing costs for both corporations and individuals (home loans, credit cards, student loans, debts). This is the number one reason that the US will face an economic slowdown during the rising rates environment in 2022.

Global Markets

China’s economy is our main focus that could produce a negative impact on the global economy. The bankruptcy of Evergrande Group is the beginning of its trouble. Not only the economic slowdown, but China threatened other countries in 2021 (US, India, Australia, Japan, Taiwan, Canada, etc) could trigger more risks including military conflicts.

Offense and Defense

Offensive stocks and industries were still strong but the leadership became fewer. Mega technology is still bullish: AAPL, MSFT, GOOGL, TSLA, NVDA, AMD. The semiconductor and network industries are still one of the strongest areas to look for candidates on the watchlist or portfolio: STX, MU, KLAC, CSCO, JNPR, FFIV

Last few months of 2021 (October-December), defensive sectors emerged up quickly including utility (XLU), consumer staples (XLP), healthcare (XLV), and REIT (XLRE). Thus, there are many stocks that are at their monthly high 52-week highs that should be monitored closely.

Large Caps Versus Small Caps

The leadership in large caps (DJIA and S&P 500) outperformed the mid and small caps (S&P 400, S&P 600, Russell 2000) in 2021. Therefore, large caps should be more attractive than small caps. One of the reasons is that market participants expected the slow down of the US economy. So money already shifted to safer areas in 2021. We believe the large caps would continue their strength in 2022.

COVID-19 and Variants

There is no doubt that COVID-19 is still with us and around the globe with its variants. Vaccines and treatments are coming up quickly but nobody knows when they will be under control. Thus, it would be reasonable to prepare for the worst instead of being overly optimistic.

Portfolio Settings

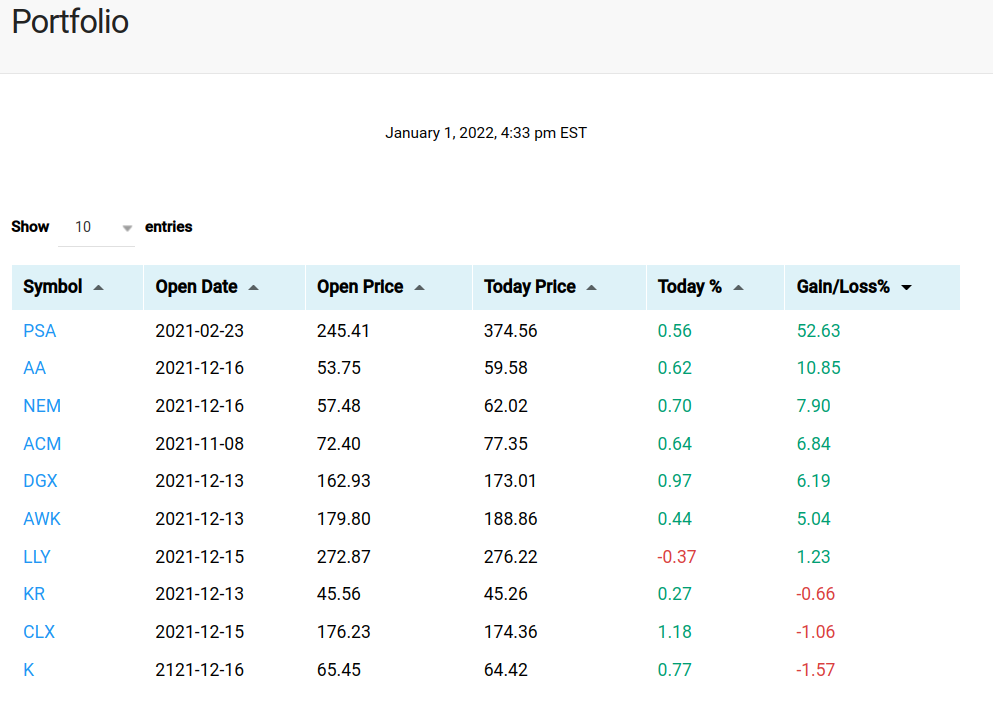

Our portfolio is shown here for your reference.

Currently, it was set toward more defensive composition. We could adjust by adding a few offensive names to accommodate the market condition if there is no sharp sell-off in the coming weeks.

Investment Strategy

There are still many stocks that emerge to their 52-week highs area in addition to the stocks mentioned above. Our investment strategy is to stay in a defensive tone but mixed with core sectors (material, industrial) and decorated with a few offensive stocks (semiconductor, software) in 2022.

- Automobile: F

- Industrial: WIRE

- Material: FCX

- Retailer: DG, FIVE

- Food: ADM

Happy New Year to you all in 2022.