March 23, 2022, 3:27 pm EDT

Let Energy and Material Lead

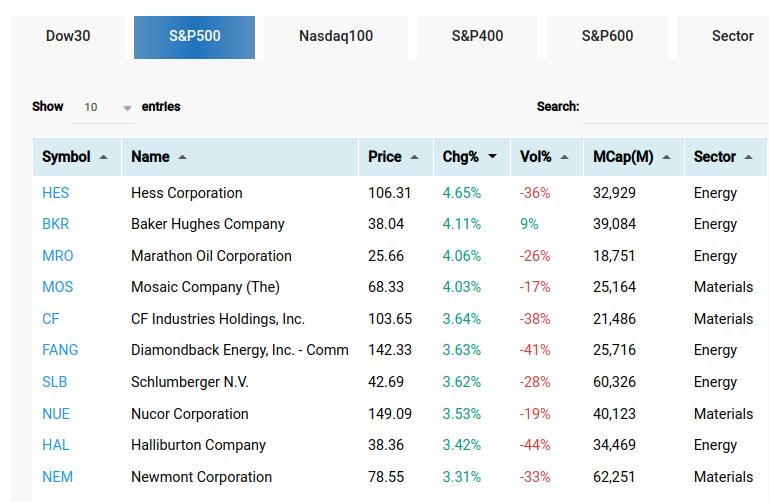

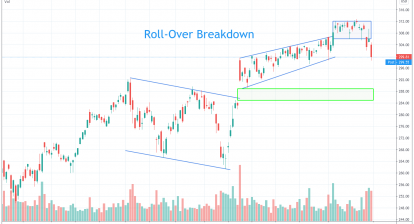

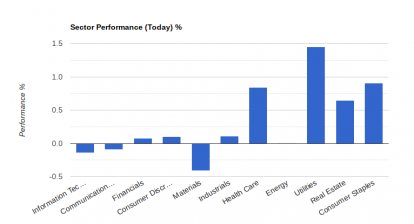

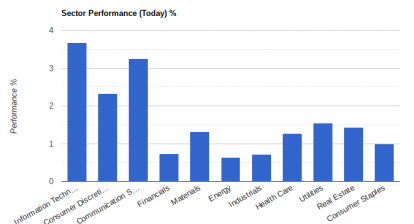

6-day rebound finishes today when all major indexes are down about -1% as of now. Although mega tech and China stocks took the lead in the past six sessions, the real sustainable strength is from energy and material as shown from the S&P 500 list.

The reason is very simple. Inflation and war are here to stay for much longer than anything else. Gamestop (GME) +13% and AMC Entertainment Holdings Inc (AMC) +16% may bounce up from the bottom like mega tech and China stocks, their ability to keep going up is questionable and unreliable. This is the difference between short-term trades (day-trade) and longer-term traders/investors (holding months or years). We think it is much more reliable to depend on a major trend or cycles that will set for months or years to come rather than speculating on daily fluctuates of up and down movement.

The rates are going to go up for sure in order to press down inflation. The war is likely to continue. Even there is an agreement or settlement between Russia and Ukraine, its damage is already done. Unstable Europe and shortage of agriculture, steel, energy, and material are going to get worse for the future. If we understand the scope of these events, then it should be easy to make investment decisions on our assets and manage the risks.

Our investment themes are inflation-favor (basic material, energy, commodities, gold), shortage-demand (agriculture, farm equipment, food, supermarket), warfare-necessary (defense, jets, missiles, nuclear), and fixed-income (REIT, high-dividend) stocks.