April 26, 2022, 11:16 am EDT

Final Call for Bears

Sometimes, people may be confused by the one-day wonder of good news like yesterday’s Twitter (TWTR) acquisition by Elon Musk. We do not think it is good news for Elon Musk or his company Tesla Motors (TSLA) which is down -9.5% now.

First of all, TWTR is a losing company from active users, earnings, reputation, etc. Its fate is similar to Netflix (NFLX) which is simply a dying process. Without a clear goal to change its structure, Elon Musk swallowed this poison pill. Consequently, its money-maker TSLA is dragged into the water.

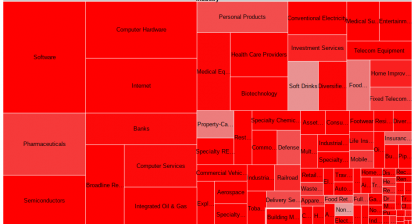

In fact, the entire stock markets resume its selling effort with Nasdaq down -3% at this moment.

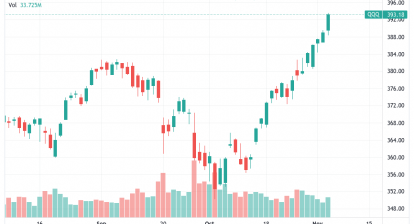

Nasdaq is near its February 24 and March 14 level 12600. In our opinion, this is the final call for welcoming the bear markets.

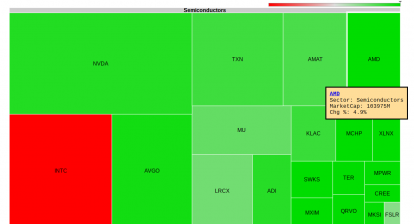

There is the bull-bear transition from January to April 2022. Now, the transition is about over. The real breakdown or sell-off is coming with the collapses of the previous leaders: NFLX, FB, GOOGL, AMZN, AAPL, NVDA, etc.

Thus, the investment strategy should be light in the portfolio holdings and high in cash level. We will keep watching individual stocks in the bear markets like treasure hunting. There will be a few emerging stocks even in the bear market. Of course, it requires careful selection, market timing, and risk management to make profits in the declining trend.

Usually, the bear market lasts about 1-2 years. So, it will be the wintertime for investment. However, if we survive well, then we will get even stronger for the spring or the next bull cycle.