June 29, 2022, 11:49 am EDT

Breakdown and New Lows in Three Industries

There are many breakdowns and new lows in the first half of 2022. But, we focus on three industries that represent the big trouble the stock markets face in the coming second half of 2022. We will use individual stocks so that we can track their charts and performance easily.

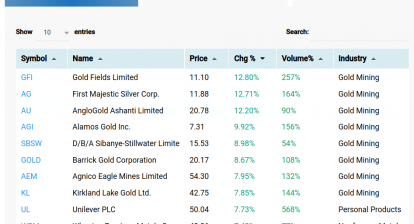

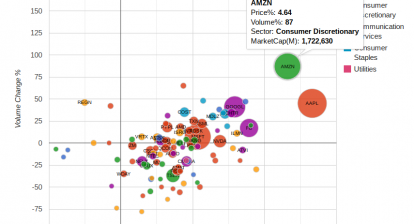

The three industries are retailer, semiconductor, cryptocurrency

- Retailer: Bed Bath & Beyond (BBBY) -20%, -65% YTD, Best Buy (BBY) -2%, -33% YTD

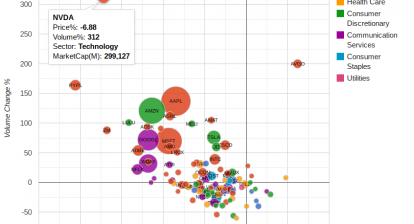

- Semiconductor: Nvidia (NVDA) -4% today, -47% YTD, AMD (AMD) -5% today, -46% YTD

- Cryptocurrency: Bitcoin (COIN) -2% today, -80% YTD

The significance of these stocks is that they display a loss of confidence from traders or investors altogether. More importantly, They reflect the reality of their peers in the same industry that suffer similar pain.

Retailer is critical to the US economy because consumer expenses count for about two-thirds of the GDP. If consumers have to tighten up belts under inflation pressure, the outlook of the US economy is in jeopardy for sure. Physical stores like BBBY and BBY are also the victims of COVID-19 and the online shopping model. Obviously, we shall see a bunch of bankruptcy and the closure of retailers in the next 6 months.

A semiconductor is used to be the strongest high-tech crown. AI, cloud, internet, electronics, electric vehicles, cryptocurrency, and almost everything that needs power needs computer chips. NVDA and AMD are also the rising stars that replace Intel. However, their weakness exposes the entire industry to encounters the slowdown of the global economy. It is unusual to see this situation. Perhaps, the markets sense the overcapacity of the chips so even the strong stocks like NVDA and AMD have to look for a new bottom.

Lastly, the dismal performance of the once shining star of COIN shows the rollover of cryptocurrencies like bitcoin, Ethereum, etc. It could be one of the biggest bubbles to burst in front of our eyes. We believe there is a lot more space to go down from the current level. We shall see a lot of bankruptcies for companies operated with this virtual currency in the next 6 months also.

In conclusion, the bear market is going to sweep throughout every place to obsolete the out-of-date business, slow down overgrown industries, and burst out unrealistic growth of new ideas. After that, a new group of survivors will come out to lead the next bull cycle.