July 22, 2022, 11:47 am EDT

Earnings Response

Earnings are a crucial factor to determine the direction of a stock. If a company can make 25% above growth on both revenue and earnings, then its stock price deserves an uptrend. If a company fails to make a penny in a quarter, it should be ready to get a harsh punishment from stockholders.

Yesterday Telsa (TSLA) was up 10% from its outstanding earnings report of 42% and 57% growth in top-line revenue and bottom-line earnings. Today we saw Snap (SNAP) tumble by 38% after a dismal report of a losing quarter.

Due to the high volatility of earnings response, we usually avoid committing before earnings. Another essential principle is to prevent the company who cannot make a profit unless it shows other outstanding growth in another area. Nobody can afford -87% down within a year for a stock like SNAP.

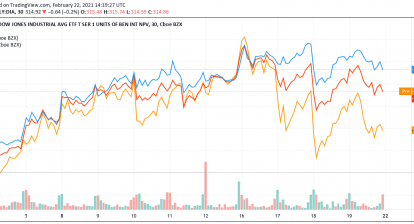

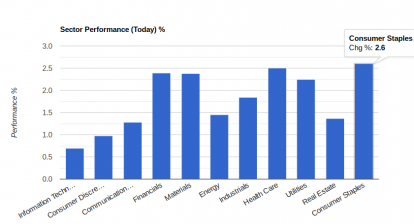

The stock market reacted positively in the past two weeks of earnings. However, the Q2 GDP report and Fed rate hikes are coming next week which are the key events to test whether it can hold it up or not. Let’s cross our fingers to watch.