March 17, 2023, 11:15 am EDT

Birdeye VIew

Sometimes, it is important to have a bird-eye view from above to know the entire picture instead of reacting to the small changes around us.

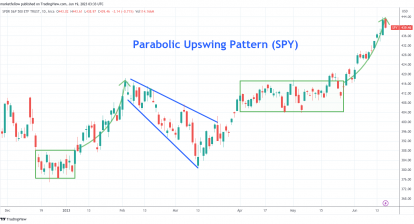

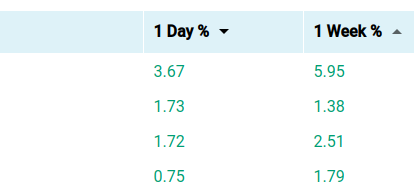

For example, the stock market made a strong rebound led by the technology stocks including semiconductors (NVDA, AMD, INTC) and internet stocks (GOOGL, META, AMZN). There could be a chance to rally higher. However, the big picture of the global economy remains troublesome from the following viewpoints:

Rescue Effort

The financial crisis for the banks like Silicon Valley Bank, Signature Bank, and Credit Suisse is temporarily solved by the governments through extra funding to either giving to depositors or the bank. Both efforts do a little help to solve the problem. Because the fundamental problem is the excess of liquidity printing in the past decades. The inflation threat is there to stay. The regional banks got into trouble first. We believe money center banks or large banks would follow in their footsteps when the housing bubble bursts with rising jobless conditions.

Military Confrontation

Russia knocking down a US MQ-9 drone is another evidence that military confrontation is going to rise. Also, the Korean leader arrived in Japan to shake hands means that it is time to choose your camp, either US-Europe or Russia-China. Meantime, Chinese leader Xi Jinping’s plans to visit Russia to meet Putin are worth attention because it marks the official partnership with Russia in order to fight with their counterpart together. It signifies that World War III is getting one step closer to reality.

The Collapse of China’s Economy

China is entering a big crisis of the collapse of the housing markets, job markets, international trades, and shortage of semiconductor chips. Since Xi got his forever-term dictatorship position, it gives him absolute power to fulfill his ambitions to invade Taiwan just like Putin did in Ukraine. Therefore, the big fight will raise the level of US-China which seems unavoidable in this background.

In summary, the direction of the global economy looks very bearish regardless of day-to-day market fluctuation. Only very few areas could do well in the stock market like precious metal-gold and silver. Perhaps, some defensive stocks in consumer staples or healthcare sectors.