November 2, 2023, 12:05 pm EDT

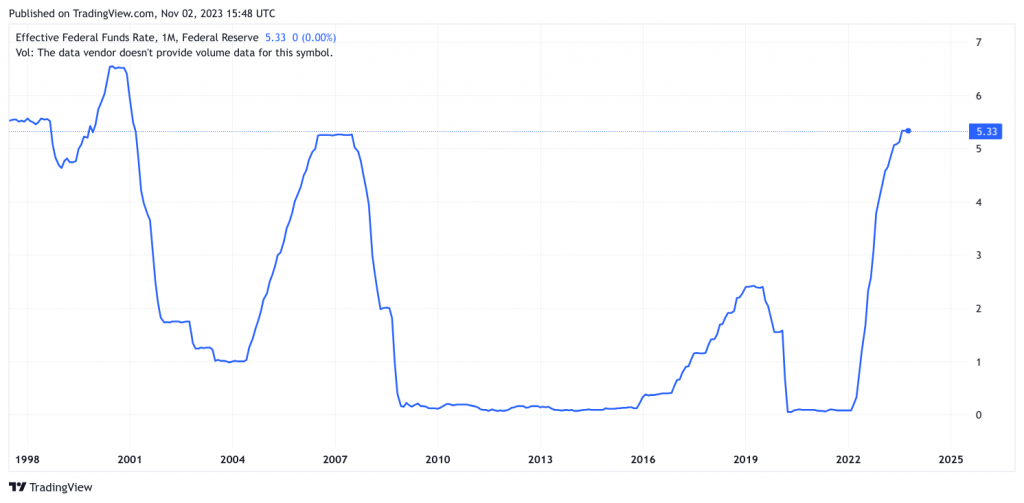

Fed Fund Rates

Federal Reserve Chairman Jerome Powell mentioned that the fed fund rates (FEDFUNDS) stayed the same to 5.25-5.50% range yesterday. Although it was expected by most observers, the stock market cheered with this action for another 400 points gain in Dow Jones index as of now.

The rise of the bond like 20 years Treasury Bond ETF (TLT) +1.8%, the fall of the US dollar ETF (UUP) -0.4%, and the rally of the stock markets: Dow Jones +1.1%, S&P 500 +1.4%, Nasdaq +1.3% reflected the expectation for the future.

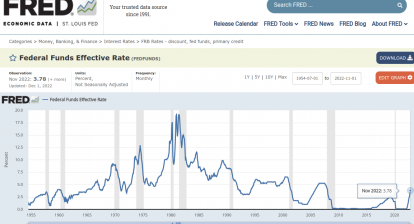

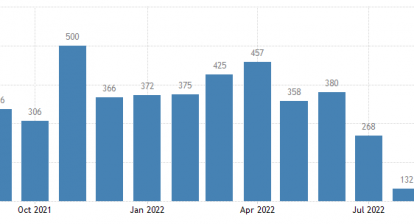

Even though Powell mentioned the higher rates would stay longer and possibility of rising rates is still there, the interpretation tends to believe that the next actions would be rate reduction. Furthermore, historical behavior points out the same conclusion like 2007-2008 as shown in the featured chart.

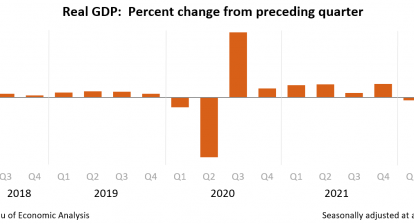

However, it is also important to point out that the rate reduction usually comes with a sharp pullback of economic growth or recession. Thus, the excitement of the stock market in these few days might be short-lived.

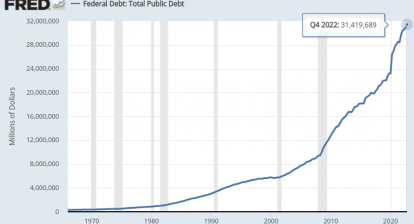

The reality is cruel when high inflation and loss of jobs come together. The lower rates do not help much for most people during the cycle of a slow economy. Therefore, it is important to control spending, save more, and stay conservative in investment.

After winter, spring will come back again. But, staying alive is the number one rule during the cold weather.