December 13, 2023, 3:40 pm EST

Aggressive Fed and Volatile Markets

Fed Chairman Powell spoke again which is the source of the volatile actions in the stock markets. It is widely expected that the FOMC to keep the Fed Fund rates unchanged at 5.25-5.50% range, However, Fed’s aggressive three rate cuts in 2024 surprised the stock markets with about 400 gains for the dow jones index as of now.

On the one hand, the lower rates will boost the capital markets with easing money supply. It would be easier to borrow money to buy houses and cars. Also, the lower rates reduce the burden on the debts like credit cards, mortgage, or student loans. On the other hand, easing policy could bring in the inflation threat like we experienced in the past 1-2 years.

Now, the inflation crisis has become less severe, about 3% (CPI 3.1%, PPI 2.5%). Moreover, crude oil went down from $94 to $68 during the last couple months. Indeed, the inflation pressure has been softened significantly for the second half of 2023. Therefore, Fed got the confidence to aggressively cut rates in 2024 in order to fight another enemy of potential recession or negative GDPs.

The stock market cheers up for now as it looks at the short-term benefit of the lower rates. But, it is important to read the mind of the Fed where they foresee a deterioration of the slowdown of the economy in 2024.

It is the Dual Tracks of Bulls and Bears 11/21 where both sides have a reason to stand.

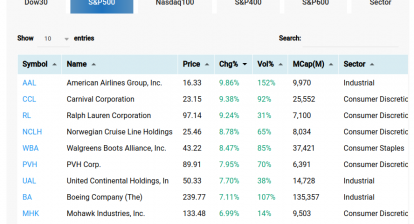

We believe it would be safer and reasonable to stay cautious in this junction. The markets are very fragile during this gyration. We like defensive types of stock like Walgreens (WBA) as we posted last week. Defensive, high-dividends, and solid business are the formula to move forward for this markets, in our opinion. .