August 26, 2022, 11:54 am EDT

Fed Hawkish View

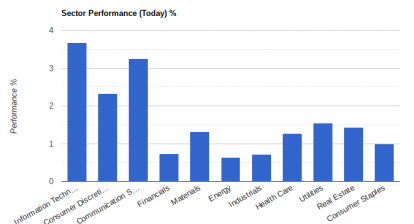

Fed chairman Jerome Powell gave a hawkish statement after the Jackson Hole, Wyoming annual meeting. His determination to bring down the 40+ years inflation level seems to be firmed. The stock markets’ hope for market-friendly Fed quickly faded away as the market is down more than -500 for the Dow Jones index now.

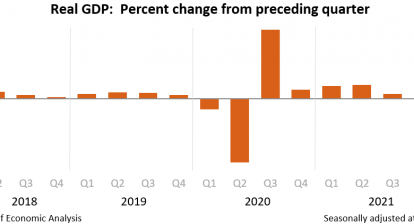

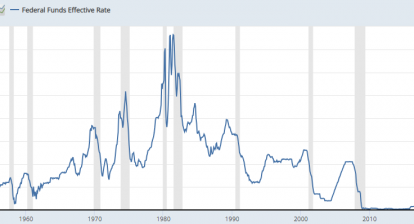

Indeed, the US central bank is the number one driving force for the stock market. Its intention decides the market direction. In the past 2-10 years, near-zero Fed fund rate and numerous stimulus plans flooded the world with a lot of the dollar. Of course, Euro, China, Japan, and other countries followed the same approach so the US experience 8-9% inflation. Other weaker countries suffer much more or even get bankruptcy like Sri Lanka. The inflation monster is likely to mess around the whole world since it has been released.

Therefore, we can see it is necessary for the Fed to fight inflation before inflation severely damages the US economy.

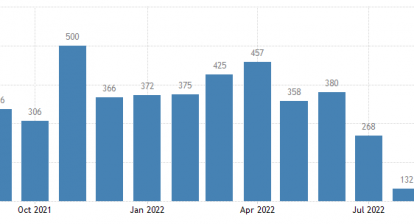

The rate hikes process is going to bring down inflation eventually. But, it will also slow down the housing markets. Consumer-related industries also will face a tough time during inflation.

The long-term view of the stock market remains bearish until the Fed changes its view on inflation.