February 7, 2024, 5:05 pm EST

The Wars and Markets

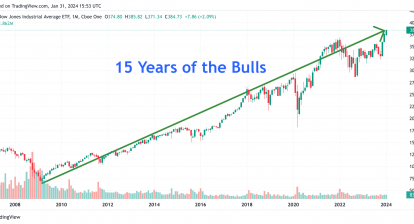

The US stock markets behave consistently with the wars. The more wars, the higher the markets.

From the Russia-Ukraine war (starting 02/24/2022) to Hamas-Israel (starting 10/07/2023), then the recent wars (starting 2024) in the Red Sea and the Middle East (US-UK against Yemen-Syria-Iraq or even Iran), we can see the correlation between the wars and the stock markets, including endless record highs for major indexes (Dow Jones, S&P 500, Nasdaq) today.

What will happen to the stock market when World War III starts?

Logically, it does not make sense because the wars consume many valuable resources including food, energy, materials, technology, and people. Numerous weapons and bombs are created and used to destroy buildings and lives. These products do not create more value. Rather, they destroyed values. How could these events be a good thing for the economy or the stock markets?

Indeed, it is ironic to experience this faction in unusual times.

We believe that the rise of the stock markets is short-term. It only responds to reality at limited time. Here are some reasons that the market ignores wars and drives up continuously:

- Inflation is under control.

- The rising rates period is going to end. The lower rates are coming in 2024.

- The surge of Artificial intelligence. It brings up these mega caps: AAPL, AMZN, GOOGL, MSFT, META, and NVDA. Those stocks are the driving force of the indexes.

Although these reasons hold. We believe the phenomenal behaviors of the stock market are temporary and not sustainable. The reasons are:

- Inflation will diverge. The prices for food and energy could rise again whereas non-essential items are dropping like TVs, computers, smartphones, clothing, shoes, cars, etc. Thus, it causes an uneven economy.

- Because of the above reason, the Fed may need to reconsider the pace for lowering the rates. Instead of March, it becomes May 2024 for the first cut.

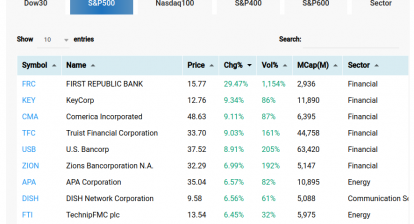

- These AI-related stocks enjoy a victory in performance due to strong demand and efficiency. However, their capability to lead the entire market is questionable. Because the majority of companies suffer in this type of market.

Here are some observation points from the economic perspective which could be the triggering hints:

- The quick slowdown in the job markets. It means slower job gains and rising unemployment rates

- The comeback of inflation in the food and energy

- The decline in sales in consumers or slowdown in GD

We do not know exactly when but there will be a turning point in the stock market. However, we do anticipate the reality of the troubles to be shown. Let’s cross over fingers and watch.