December 30, 2023, 10:55 am EST

Surprised Ending of 2023: +14% +24% +43%

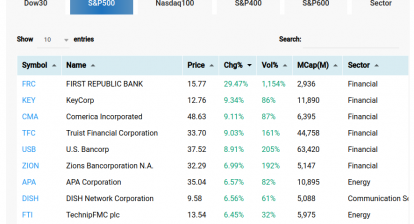

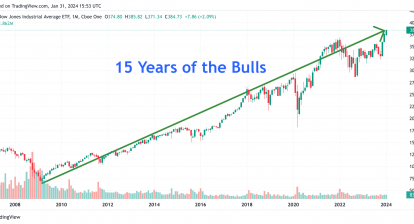

It should be a big surprise for most market participants to see this scorecard: Dow Jones +14%, S&P 500 +24%, Nasdaq +43% performance for 2023.

Here are the list of surprised events:

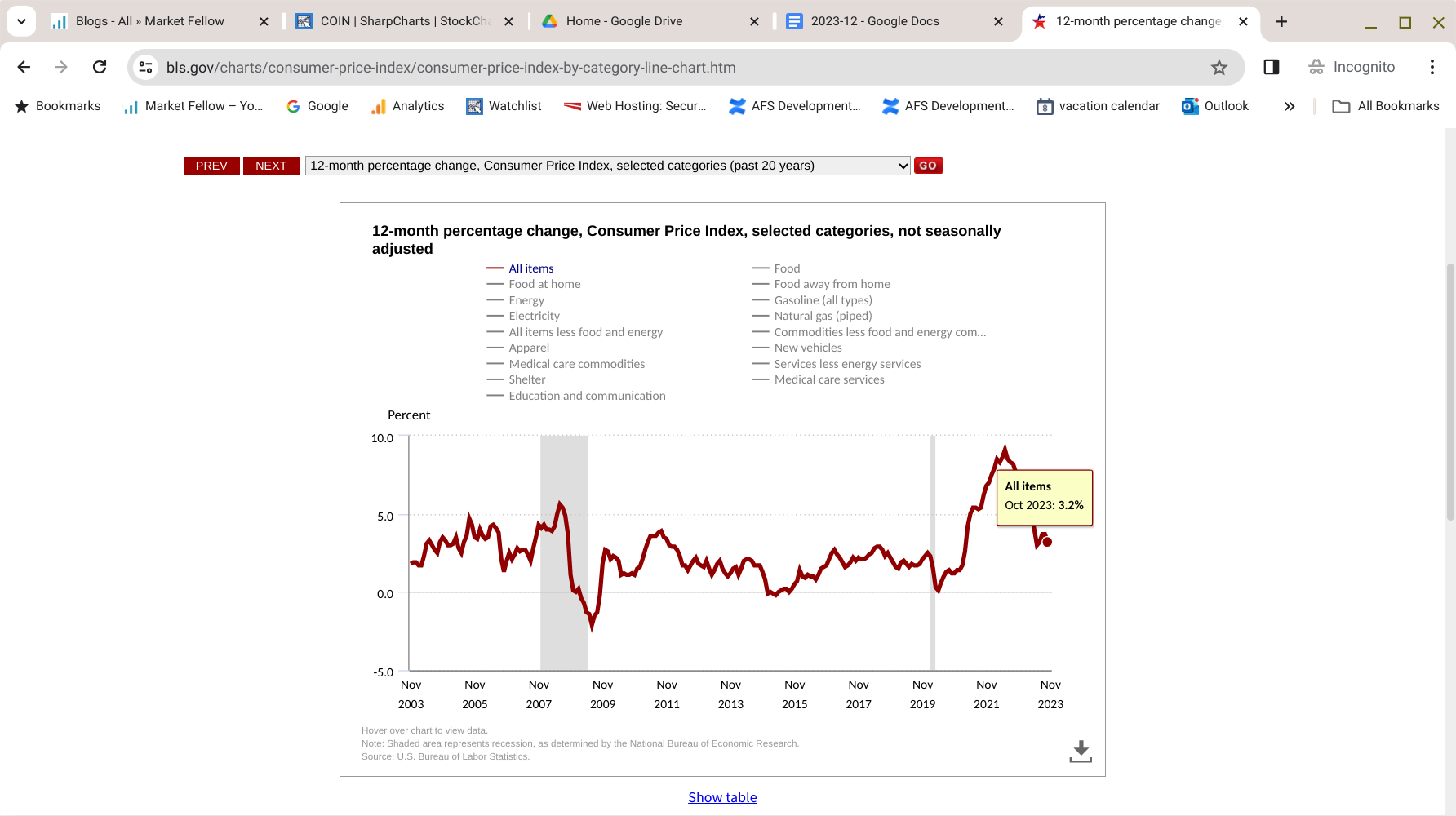

Faded Inflation

Faded inflation was the number one factor to drive up the stock market, in our opinion. From the peak of 9.1% (2022/06), to the midpoint 6.4% (2023/01).

The CPI data kept falling to the lowest point 3.1% (11/2023).

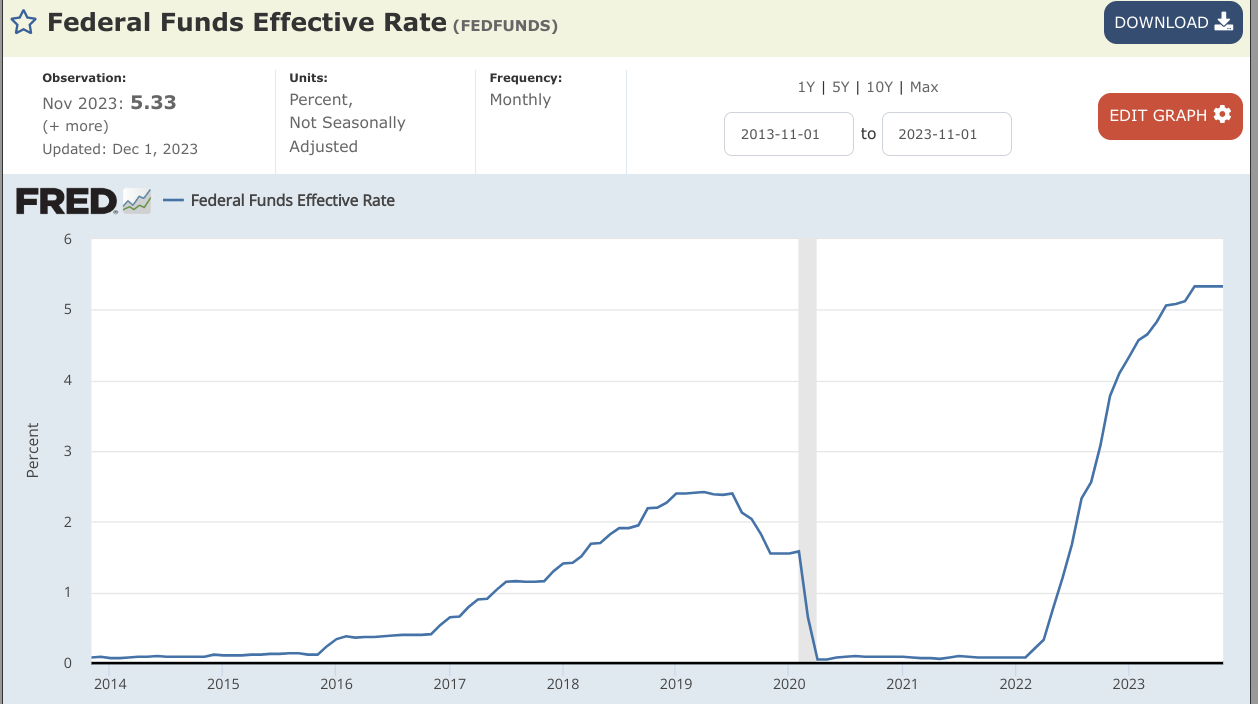

Aggressive Fed Fund rates policy adjusted the rate from 0% to 5.25% proved to be powerful and effective. Compared to the housing price chart we can see it impacted the price from 479K (Q4 2022) to 418K (Q2 2023).

But, it began to rise up again in the latest data 431K (Q3 2023). Therefore, the Fed successfully controlled the inflation in 2023. When Fed and market participants concluded this fact, it began one of the strongest rallies in the last two months of 2023 with nearly 15% – 20% gains.

Cheer Reactions During Wars

It is hard to believe but it seems to be true that the prolonged war of Russia-Ukraine and the spread conflict in the Middle East did not produce a negative impact on the stock market in 2023. Ironically, the stock market ignored the Hamas-Israel war that started in early October. Surprisingly, it kept going up in the background of deepening involvement in the spreaded crisis in the Middle East. Crude oil price also reduced from $94 to $68 per barrel during September to December 2023. It seemed like the stock market cheered with the rising problem there.

Cryptocurrency Rally

SEC approval of the coming cryptocurrency ETF injected the power for almost all crypto to rally, including the platform Coinbase Global Inc (COIN). It jumped from $70 to $185 as shown.

AI and Semiconductors

ChaptGDP with its Artificial Intelligence revolution convinced people that the new era is coming. It could eliminate many human jobs in the future. But, the stock market cares about its superpower and disregards its potential negative outcome to the broader outcome. Mega techs (MSFT, GOOGL, META, AMZN, AAPL), and semiconductors (NVDA, AMD) are winners of this change.

No Response with the Fall of China

De-risking or decoupling kept happening between US-Europe with China. China also faced its own housing bubble and other issues. However, the decline of China and Hong Kong did not drag down the US stock markets in 2023.

These outcomes may not last long but it made up the rally for 2023.

Do you expect these results on January 1, 2023? If not, you are not alone.