December 26, 2023, 12:16 pm EST

Keep Squeezing The Last Juice

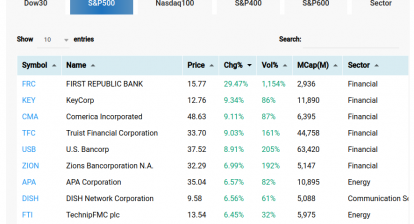

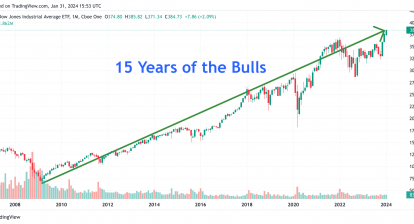

The stock market keeps squeezing higher. It seems like squeezing the last juice for the rest of 2023.

Indeed, the relief of the inflation threat in late October and coming of the lower rates in 2024 did provide a lot of power to hype the stock markets into new highs for all indexes. The double-digits gains within 1-2 months were very impressive and surprised.

However, we are still not optimistic to believe that this rally will go very far. Here are concerns.

Housing Prices

Housing prices bounced back quickly in response to the lower rate expectation. It means that the effect of lower gasoline prices was canceled by the rising cost of rent, mortgage, and house prices again. We believed that the problem of affordable housing or rental will stay much longer. Consequently, the US economy will get back into muggy ground because a lot of younger generations or who do not have a house yet would suffer. They will have less money to spend due to the burden of housing expenses.

China Slowdown

The slowdown in China in terms of its own debts, less exports, and crisis in housing, manufacturing, jobs, consumer spending, are going to continue to worsen in 2024, in our opinion. Their stock markets including Shanghai, Shenzhen, and Hong Kong are at the year-low level. Compared to year-high or all time high in the US, Japan, India, etc, the outlook for the economy in China is dismal. Potential outcome of the shaky economy would spread into the US and Europe in 2024 in many ways since China is the second largest economy in the world.

Geopolitical Uncertainty

After the first major war occurred between Russia-Ukraine in February 2022, the second war Hamas-Israel started in October 2023. Both wars are far from over. In fact, they are either stagnant or spreading out. If the third one comes in Asia like China-Philippians or China-Taiwan, then it definitely will hurt the global economy for sure. It has not happened yet. But there are signs that China is adding pressure in these regions.

In conclusion, the performance of the US stock markets show a bullish outlook and strong power since October 2023. Yet, we pay attention to the above conditions. We do feel that these concerns may appear to drag the stock markets down in 2024. So, we keep a cautious outlook into 2024.