August 1, 2024, 12:25 pm EDT

Rate Cut and Market Top

Historically, rate cuts occur at the top of the stock markets.

Yesterday, Federal Reserve Chairman Jerome Powell mentioned the interest rate (Fed Fund Rate) reduction is coming in September. Stock markets reacted with high volatility this week.

The reason is that it marked a major milestone to both the ending of the rate hike and the beginning rate cuts. In other words, it notes the major turning point from these policy makers that consisted of economists and financial experts. They know it is the time to “save the economy” before the real problem surfaces.

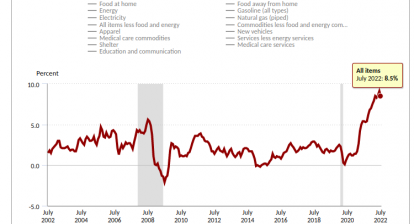

The market participants or the stock market understands the language of the Fed and potential outcome for the future. Therefore, both bulls and bears presented their aggressive behaviors. On the one hand, the bulls think the lower rate will help the home buyers so the housing markets will be strong continuously. Also, the lower rates help the economy with more lending power to buy cars, pay less rates on the loan, or assist businesses with easy borrowing. On the other hand, certain people realize that hyperinflation is near the end and a slowdown of the economy is on the way. Even the lower rate cannot boost the housing market further because the housing market is already too hot or unaffordable. Furthermore, an economic slowdown will appear on corporate earnings that would drive more layoffs and less opportunities for average people to make money.

We take the bear’s side. Not only is it more reasonable, but also the chart approves what we thought.

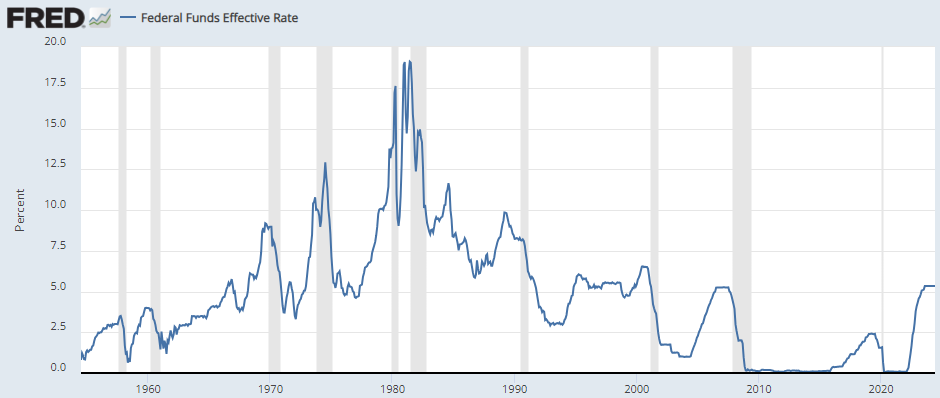

Looking at the featured chart of Federal Funds Effective Rate where we can see the rates (solid blue line) and recessions (gray bar zones). It is self-explainable that every recession happens after the rates begin to go down.

Therefore, we believe that this time would be the same. Rate cuts will come at the market top.