05/12

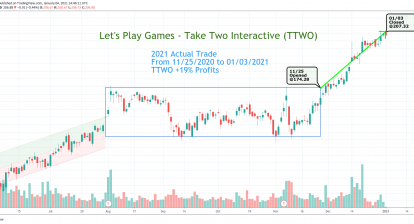

Stock markets made strong rebound in the past two months since March. The power is provided by government money-printing strategy so it could dry up.

Banks, hotels, cruises were up significantly from bottom for this reason.

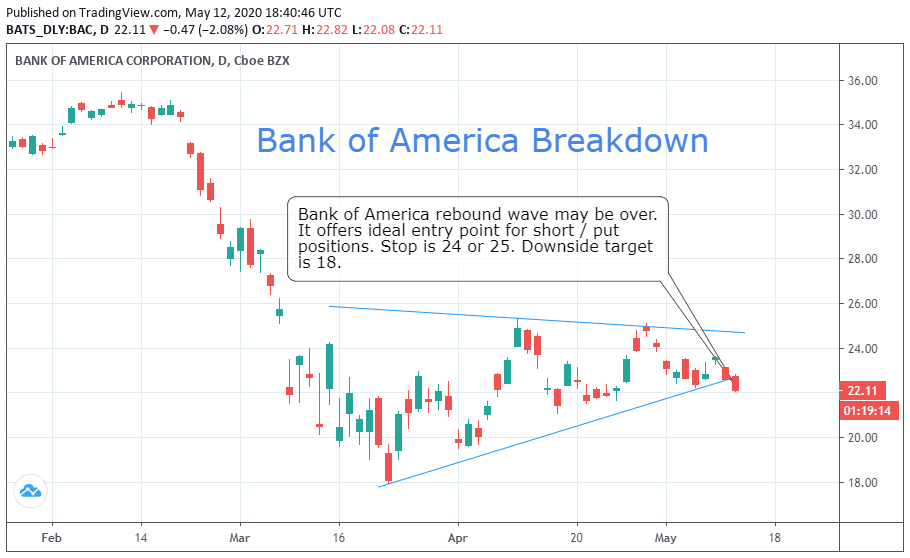

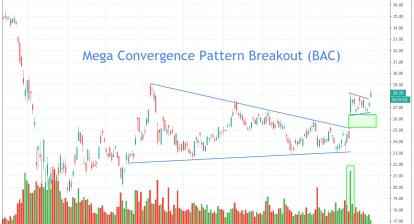

Bank of America is an example that technical analysis helps to point out potential direction at the end of convergence.

Breakdown is more likely at this level. Upside risk is about 24,25 (recover stop) but downside risk looks bigger to 18.