July 21, 2020, 2:55 pm EDT

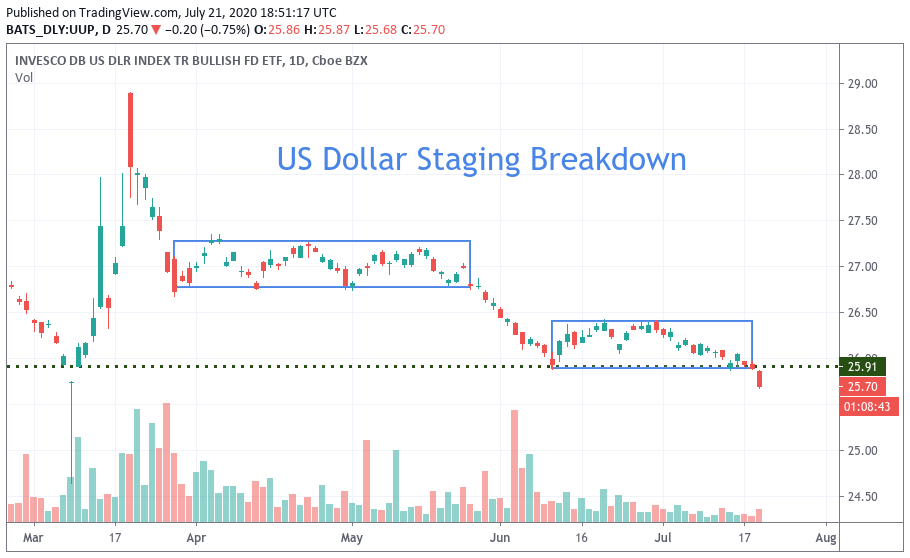

US Dollar Dives Again

Whenever there is news of another round of stimulus, relief package or program, it means more dollars are to be printed and flow to capital markets. In most cases, people are happy to receive cash from their government through unemployment benefits, or cash payment. Companies receive paycheck protection money, no-need-to-payback business loans, etc. It seems to be win-win-win for both government, people and business by printing more money. It definitely helps to solve some short-term issues like viruses or shrinking jobs. But, there is a price to be paid in terms of currency depreciation and inflation. Let’s focus on the inflation issue in this article.

Almost all commodities like energy (crude oil, natural gas), food (beef, pork, corn, orange, beans), , material (steel, copper, cement) and precious metal (gold, silver, platinum) are traded through the US dollar. Thus, sudden increase in the US dollar, assuming products stay with the same amount, will cause commodity prices to get higher. If this condition remains for a longer time, then higher commodity prices will propagate to almost everything people need to use money to buy. From gasoline for cars, milk in the supermarket, clothing, shoes, etc. If inflation is out-of-control, this control will face a big chaos. The US does not get into such a worrisome condition yet. Policy makers understand the risks but try to walk on the edge of the cliff carefully.

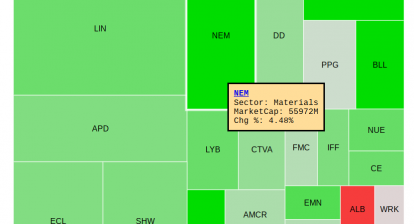

Meantime, commodities in energy, material, food may begin to react on falling US dollar by rising higher.