December 18, 2020, 10:02 am EST

Winnebago, the Way To Go: WGO

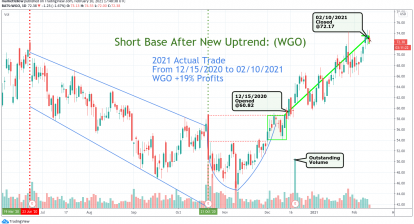

As we mentioned in the 12/15 article “New Lifestyle For Post Pandemic Era: WGO” , Winnebago (WGO) did not disappoint us by making a strong earning report this morning. 2021 Q1 WGO Earning Report highlights

- Quarterly Revenues Up 34.8% Year-Over-Year, Bolstered by Strong End Consumer Demand

- First Quarter Gross Margin Expansion of 390 Basis Points

- Reported Diluted EPS of $1.70; Adjusted EPS of $1.69 Up 131.5% Over Prior Year

- Record Order Backlogs and Retail Sales Momentum Validate Continued Interest in the Outdoors

+35% sales growth is solid evidence that its business enters into a high growth period. It is important to note that sales or so-called top-line are the total money received by providing products or customers whereas earning is the bottom-line after subtracting expenses, cost, etc. Sometimes, earning growth can be manipulated by cutting costs to boost its numbers. But, sales growth is the key for a long term growth and harder to deceive investors. Thus, WGO should have a good start for 2021.

Technically, a breakout with a high volume is the pivot point to start its uptrend rally. Hopefully, WGO turns on its engine to have a pleasant journey for weeks or months to come.