February 27, 2021, 6:32 pm EST

Watch Out Market Top

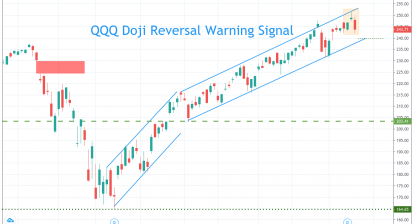

Stock markets went through a major top-out process last week (Nasdaq, S&P 500) and this week (Dow Jones). It is important to check the market status and adjust portfolio settings accordingly.

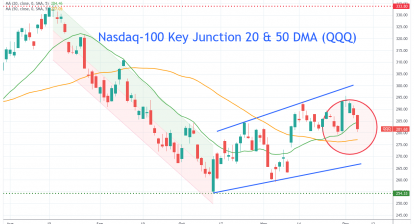

We can use the technical analysis chart Nasdaq 100 (ETF: QQQ) as an example. QQQ has had a strong rally since November 4, 2020 or four months ago. QQQ was able to stay above its 20 (orange line) and 50 (green line) Day-Moving-Average (DMA) lines until this week. QQQ gave up both important short-term and medium term lines on 02/22 and 02/26 that was an indication of a bearish signal.

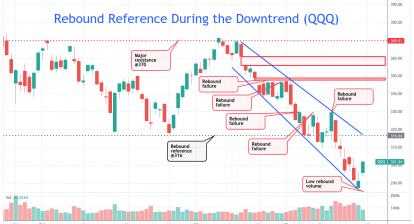

Based on this information, traders or investors should reduce Nasdaq or technology-focus stocks in the portfolio. If next week Nasdaq cannot recover its 50 DMA line, then stock markets may receive major pullback or correction for about 10-20% drop from the top.

Trading strategy should consider followings:

- Reduce market exposure by selling stocks

- Change to defensive type of stocks like food, REIT, or individual strong stocks

- Add short / put / bearish ETF as hedging positions if you are experienced about controlling the risks