March 6, 2021, 8:41 pm EST

Nasdaq in Trouble?

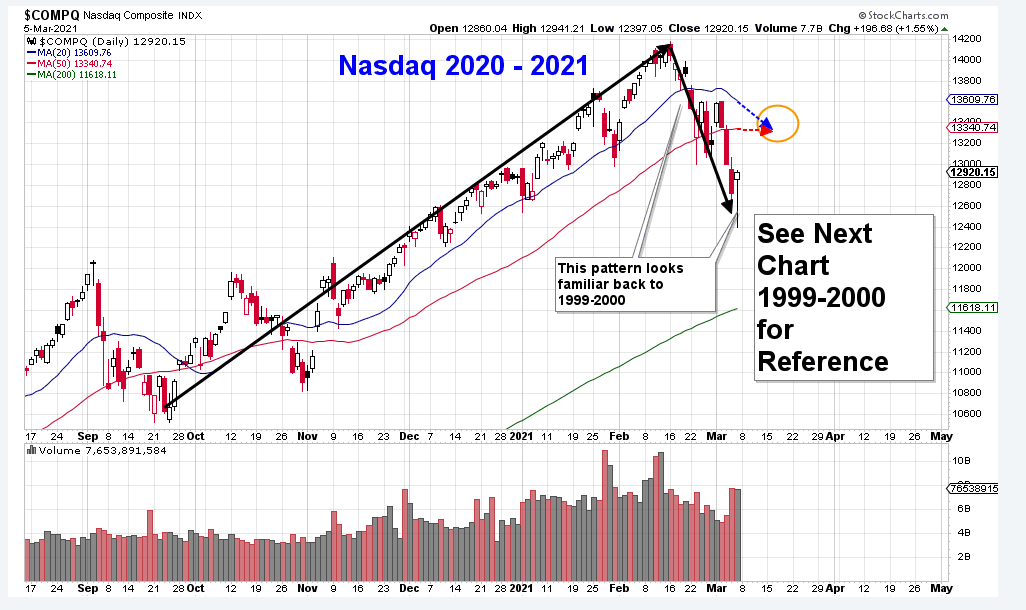

Nasdaq made a top or historical high on 02/16 14200 vs 03/05 intra-day low 12400. It was a near -13% drop in a couple of weeks. Tesla (TSLA) made a -40% decline (900-550) also in the past few weeks. That reflected a change in investors’ minds. Does it mean Nasdaq is in trouble now?

Dow Jones and S&P 500 are still in strong shape compared to Nasdaq. But, it does not mean Nasdaq would be back to record high again.

It reminds us of the history of Nasdaq, which is a technology-focused index, full of innovation, IPOs, and volatility. In the bull’s run, it ran much faster than S&P and DJIA, but it could be a leader to the downside also when bears are in control.

Please check out the Nasdaq chart back to the 1999-2000 dot-com bubble era when Amazon, Yahoo, Qualcomm dominated the Nasdaq with a bunch of companies that disappeared by now. Nasdaq made a top on 03/13/2000 at 5100 vs 1600 on 04/03/2001. Please pay attention to its pattern during March-April 2000 because we will compare it with today’s Nasdaq.

Nasdaq quickly crossed down 20 and 50 moving average lines in the later March 2000. Then it made an intra-day reversal on 04/04/2000 where we can see the long candlestick shadow. Then, it was a three-day rebound (04/05-07/2020). On Monday 04/10/2000, sell-off came again for the whole week (04/10-14/2000) with a near -7% drop for Nasdaq.

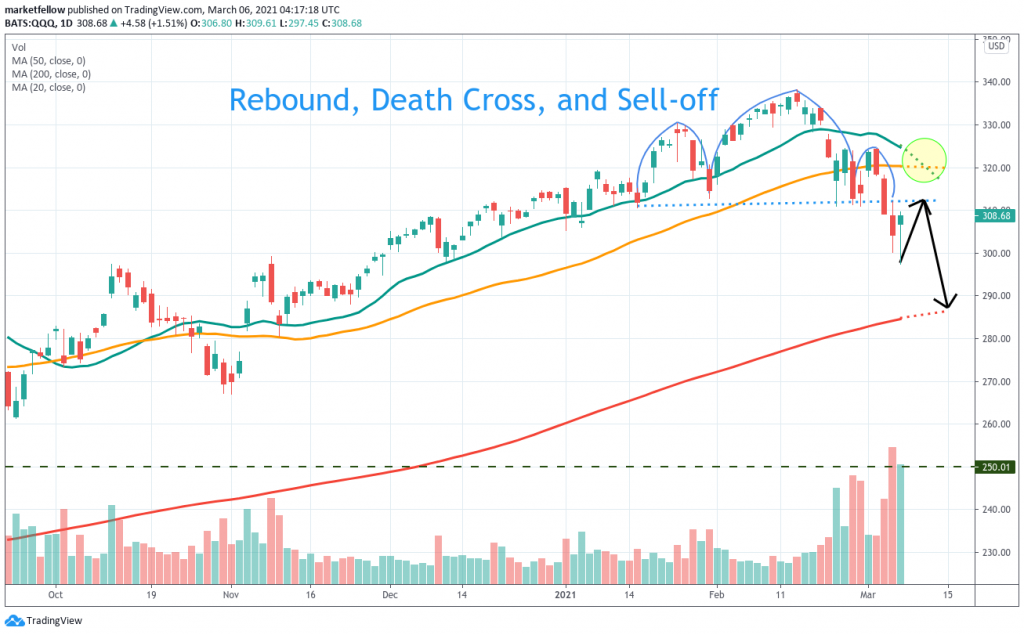

Now, by checking out today’s Nasdaq chart, we can make a correlation to the history, 21 years ago. So, a sharp intra-day reversal 03/05/2021 maps to 04/04/2000. If the history happens again, we would see a rebound and sell-off.

Of course, it may not happen or it is not reasonable to expect the exact same behavior. But, it provides a reference to gauge one possibility.

When the Nasdaq gain about +100% for the past 12 months, it is fair to expect trouble time for Nasdaq in the short term to digest its gains by the outflow of the money.