March 14, 2022, 4:07 pm EDT

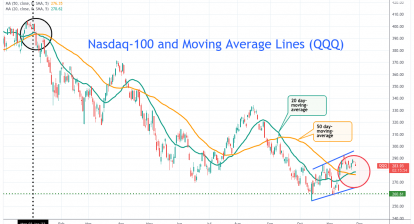

Downtrend Channel and Support Line (QQQ)

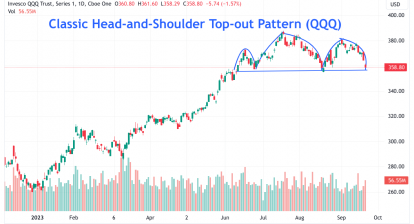

Nasdaq has been in the consistent downtrend channel since the beginning of 2022 as shown in the Nasdaq-100 ETF (QQQ). Also, the key horizontal support level 381, made by the intra-day low of February 24, was being tested today. If this is broken, then the downtrend channel is going to continue. More importantly, we expect a much stronger sell-off to occur when making a new local low.

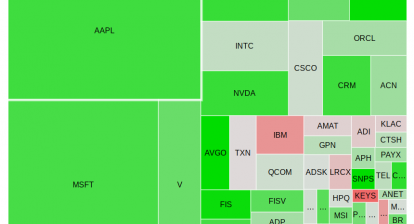

Once shining stars of AAPL, AMZN, MSFT, GOOGL, FB, NVDA, ARKK display the same destiny of downtrend or new lows. Chinese stocks fell 50-90% values from their highs in only a few months: DIDI, BILI, PDD, BABA, JD, EDU. Thus, these pictures should be obvious that bears are roaring.

Although the Dow Jones index was able to hold up a green color today, it does not change the overall picture of a bloodshed map. All major indexes are falling further away from their trend lines (20, 50, 200 day-moving-average) that describe their weakness and lack of ability to rebound.

Some strengths existed in healthcare: JNJ and consumer staples: WMT. But, overall conditions of the stock market behave defensively.

The development of the Russia-Ukraine war is still going. Coming rate hike is coming this week when inflation is at 40 years high. COVID-19 is spreading out quickly in China that caused the shutdown of major cities in Shanghai and Shenzhen. Any good news from the above could produce a rebound. However, stock markets face troubles in all directions so even the rebound could be short and weak.