November 22, 2021, 4:01 pm EST

A Warning Signal

It is essential to pay attention when a warning signal appears. It reminds you to be alert and ready to make a decision quicker than usual. Sometimes, nothing happens. But sometimes, this signal gives you ready to move to a safe place for protection.

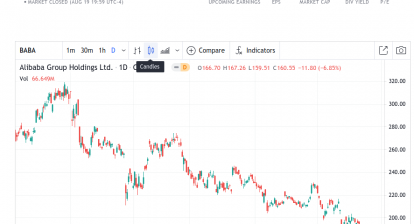

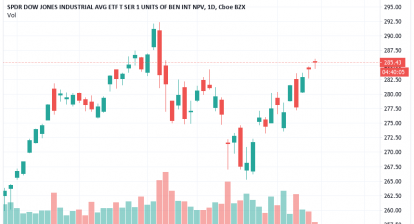

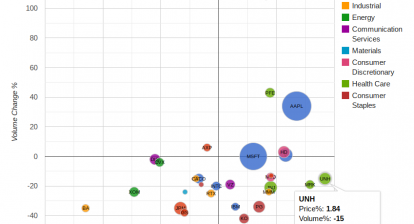

This is exactly what happened today in the stock market. DJIA was up more than three hundred points during the normal trading session but ended up with 17 at the closing bell. S&P stayed mildly negative -15 points. But Nasdaq lost ugly -202 points or -1.3%.

Based on the featured chart of S&P 500 EFT (SPY), we can see a long shadow from the candlestick pattern. When this pattern appears at a record high level, as it did for S&P500 and Nasdaq, it meant a warning signal. It could be the reversal signal for topping-out or it could be a normal day for profit-taking.

We do not know exactly what would happen for the next 5 weeks until the end of 2021. However, it would be time to be cautious if it means for a downside reversal from here.

Stay alert.