January 10, 2022, 10:10 am EST

Bloodshed Breakdown

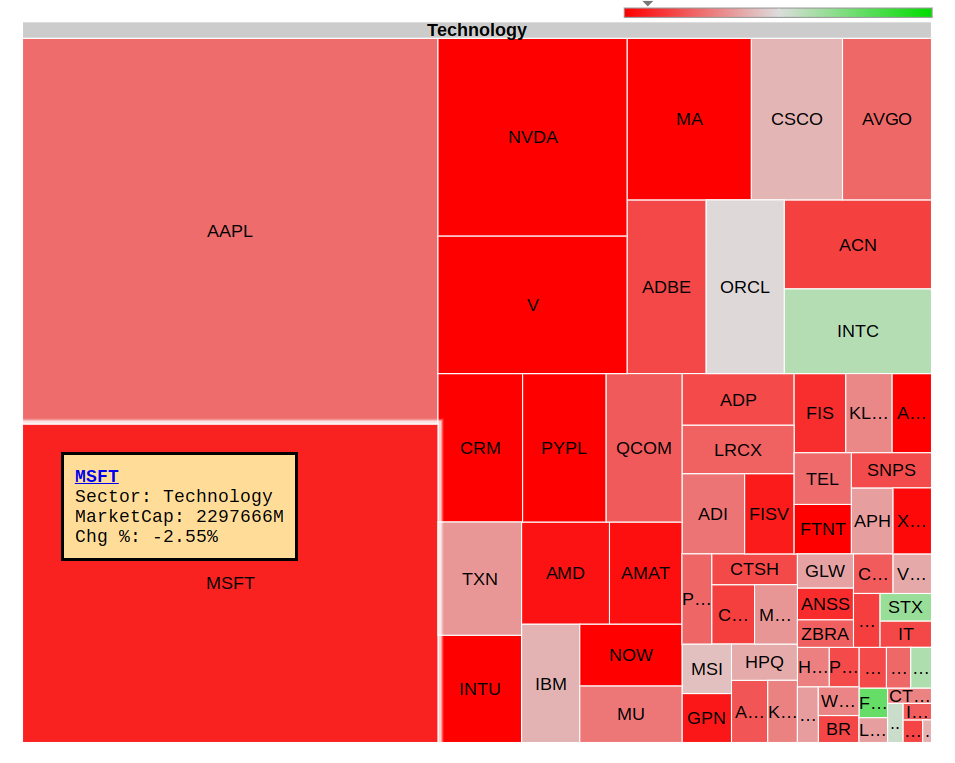

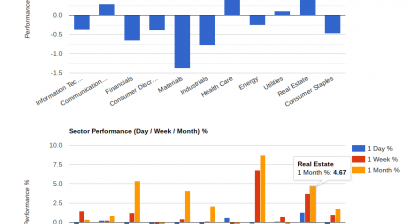

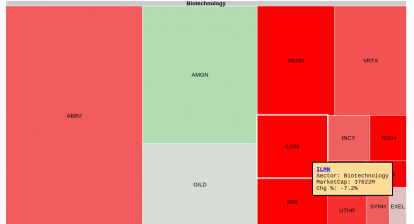

The bloodshed breakdown of the street markets kept coming this week as all major indexes were covered by the red color at the opening bell. DJIA is down -500 points or -1.4%/ S&P 500 fell -1.8%. But Nasdaq tumbled -2.3%. This is the first time since 2020 that Nasdaq lost the 200-Day-Moving-Average line. Technically, Nasdaq is already beaten down by bears for short-term, medium-term, and long-term trends. Needless to say, the big trouble is officially started. It could be an earlier time we would like to call the end of bulls that began in March 2009 which is about 12 years ago.

Although Dow Jones Index and S&P 500 made a new record high 4 trading days ago, they are more likely to follow the footstep of the Nasdaq because the entire markets suffer the same economical problem.

As we pointed out last Friday about the job data, the rising rates environment will begin to hit all markets. It includes job markets, housing markets, crypto markets, and stock markets. Hyperinflation is caused by the governments with their monetary and fiscal policies that are about to set the global economy in near out-of-control status. Moreover, endless record-high level debts are ready to show their power.

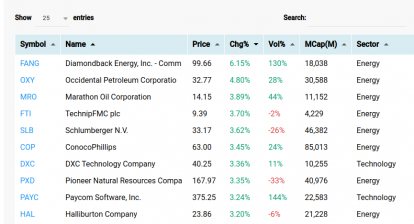

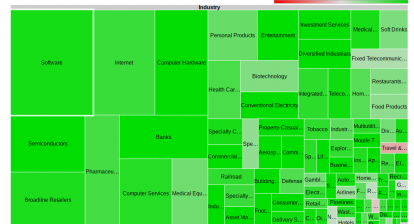

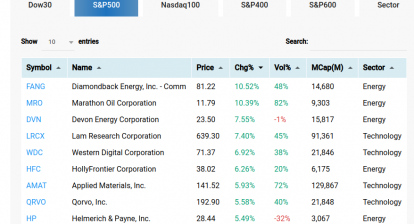

The best investment strategy is to reduce holdings on portfolios. Some defensive types of investments like food or consumer staples may survive and do well. But, financial storms would hit most places.