March 2, 2022, 2:16 pm EST

Surprising Turnaround

It is a surprising turnaround based on stock market performance today with about 600 points gains in DJIA. There could be three factors to contribute rally today.

First, it assumes that the war could end soon. Although there is no clear outcome or the progress of the Russia-Ukraine battel, markets might assume the settlement is near. More likely, Russian leader Putin cannot take control of Kyiv or any major cities in Ukraine after several rounds of attacks. It means that the pressure of economic sanctions would increase quickly to Russia. Consequently, Putin would need to acknowledge the failed actions to initiate the war. Perhaps, this is the first reason that market is very optimistic about the conclusion of the war. However, there is no way to confirm this speculation at this moment.

Second, it could be the Fed’s decision on the rate hike. Markets may think Jerome Powell and his team may take less aggressive steps toward the tightening process due to the war. This could be true. But, we have to remember that inflation will spike much faster and higher due to the rise of energy (crude oil and natural gas). A slowdown on rate hikes would simply extend the pain of higher prices which eventually will choke on the business and consumers altogether.

Lastly, it must be the economic-reopening due to back-to-normal expectations from COVID-19. This reason could also be true according to the overall conditions of its development. People will go back to the office and masks may not be required. One big assumption is that there are no more variants or any resurgence of the COVID-19 again. Again, it is the best hope but nobody can guarantee it.

In summary, we can see all these three factors which could turn into market favors if everything works perfectly together so that troubles are resolved. In reality, it may not be true.

However, the market is still finished today with outstanding performance. Here are results that reflect the sentiment of our points:

- Retreat of Defense Stocks: LMT, NOC, LHX

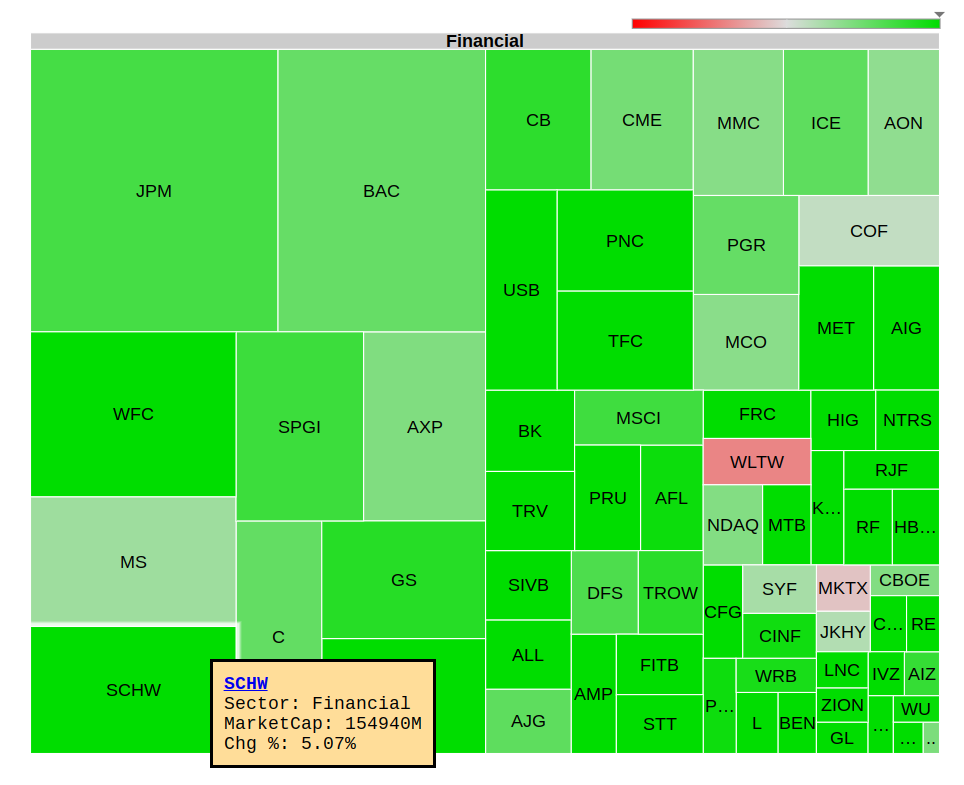

- Rising of Financial Stocks: XLF +2.6%

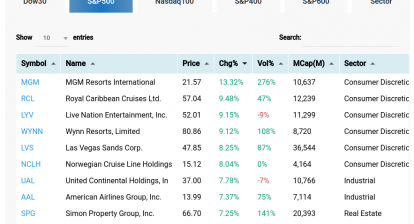

- Rising of Retailers, Hotels, Travels: JWN, FL, GPS, KSS, ROST, BIG, LULU, NKE, LVS, WYNN, BKNG, ABNB