March 4, 2022, 11:37 am EST

Remembering World War

The exact date for world war II is Sep 1, 1939 – Sep 2, 1945. Most likely none of us went through it unless you are 80-90 years old now. However, Russia’s invasion already let us feel like world war III is approaching us quickly.

In addition to full-scale attacks with tanks, jets, bombs that killed a large number of citizens and soldiers, millions of people became refugees. Most importantly, Putin already threaten to use nuclear weapons a few days ago. Yesterday, a nuclear power plant in Zaporizhzhia Ukraine was near attack by bombing. It is difficult to think about the consequence if the largest nuclear plant in Europe is exploded. At this moment, the US, NATO, and European countries kept condemning and adding sanctions. United Nations kept talking and voting but nothing changes the determination of Putin to take over Ukraine.

On the other side, China is to prepare its action toward Taiwan that is similar to Russia’s invasion. Larges numbers of fighting jets and bombers crossing over the borderline of Taiwan since last year intensified the threat. Russia Putin and China Xi are both dictators who understand that the US and Europe are weak in actions toward their aggressive actions.

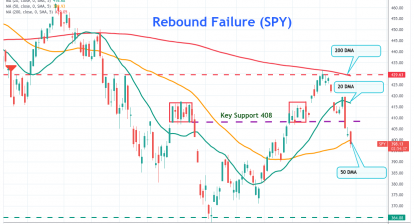

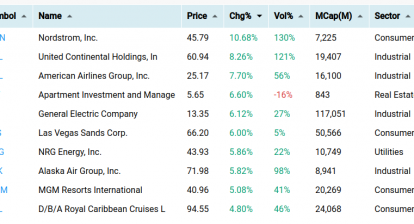

Therefore, the stock markets react with down nearly -500 points in the Dow Jones index. A strong job report with 678,000 new positions did not help at all as the focus is on the Russia-Ukraine condition. Energy and utility sectors are in the green color among all sectors. The railroad industry is also strong (NSC, CSX, UNP, CP). Food industry KR keeps going up another +3.5% after yesterday’s +10% gap-up. The financial sector (XLF) -2.5% is the worst-performing sector due to a series of economic sanctions.

There will be winners in the stock market under this condition. For example, material (AA) is up +5% in expecting more orders to make airplanes. The defense industry is also flying higher for coming orders to make jets, tanks, and bombs. Moreover, the precious metal in gold and silver keep going higher as an alternative way to keep their assets. Lastly, the food-related industry emerges to prepare for the coming food shortage.

In general, this is a very tough market to stay in the green color for your holdings. So, trimming down weak positions to raise up cash levels would be a good choice if you do now know how to handle this market condition.